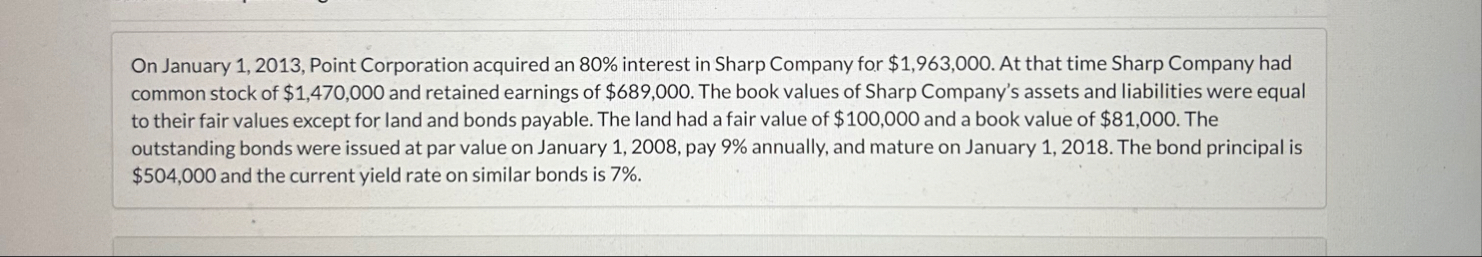

Question: On January 1 , 2 0 1 3 , Point Corporation acquired an 8 0 % interest in Sharp Company for $ 1 , 9

On January Point Corporation acquired an interest in Sharp Company for $ At that time Sharp Company had common stock of $ and retained earnings of $ The book values of Sharp Company's assets and liabilities were equal to their fair values except for land and bonds payable. The land had a fair value of $ and a book value of $ The outstanding bonds were issued at par value on January pay annually, and mature on January The bond principal is $ and the current yield rate on similar bonds is

Prepare the workpaper entries necessary on December to allocate and depreciate the difference between book value and the value implied by the purchase price. Round answers to decimal places, eg If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.

Account Titles and Explanation

Debit

Credit

Land

Goodwill

Interest Expense

Unamortized Premium on Bonds Payable

Difference between Implied and Book Value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock