Question: On January 1 , 2 0 1 9 , Cayce Corporation acquired 1 0 0 percent of Simbel Company for consideration transferred with a fair

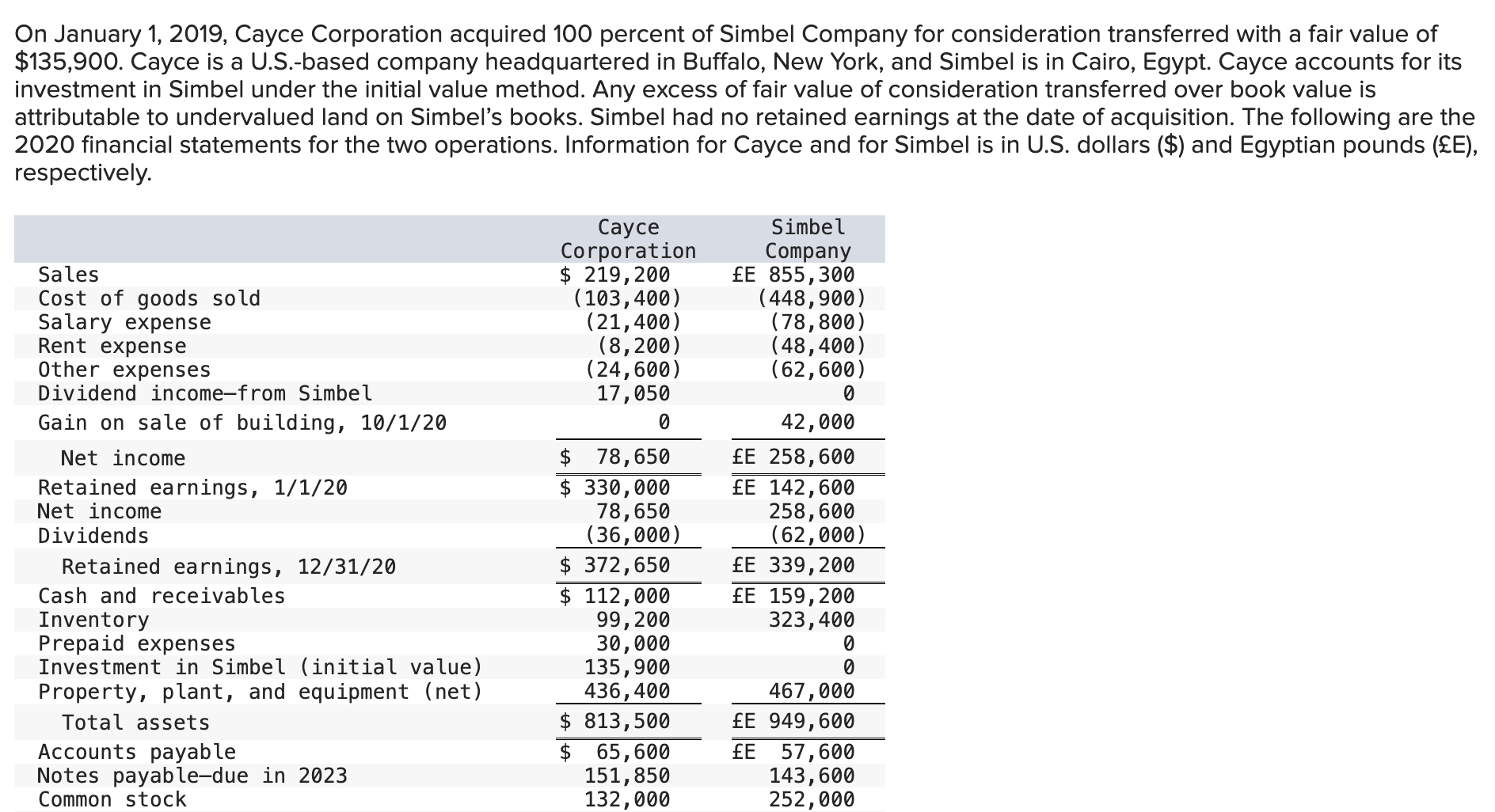

On January Cayce Corporation acquired percent of Simbel Company for consideration transferred with a fair value of $ Cayce is a USbased company headquartered in Buffalo, New York, and Simbel is in Cairo, Egypt. Cayce accounts for its investment in Simbel under the initial value method. Any excess of fair value of consideration transferred over book value is attributable to undervalued land on Simbels books. Simbel had no retained earnings at the date of acquisition. The following are the financial statements for the two operations. Information for Cayce and for Simbel is in US dollars $ and Egyptian pounds E respectively. On January Cayce Corporation acquired percent of Simbel Company for consideration transferred with a fair value of

$ Cayce is a USbased company headquartered in Buffalo, New York, and Simbel is in Cairo, Egypt. Cayce accounts for its

investment in Simbel under the initial value method. Any excess of fair value of consideration transferred over book value is

attributable to undervalued land on Simbel's books. Simbel had no retained earnings at the date of acquisition. The following are the

financial statements for the two operations. Information for Cayce and for Simbel is in US dollars $ and Egyptian pounds E

respectively. Additional Information

During the first year of joint operation, Simbel reported income of E earned evenly throughout the year. Simbel

declared a dividend of E to Cayce on June of that year. Simbel also declared the dividend on June

On December Simbel classified a E expenditure as a rent expense, although this payment related to prepayment

of rent for the first few months of

The exchange rates for E are as follows:

Translate Simbel's financial statements into US dollars and prepare a consolidation worksheet for Cayce and its Egyptian

subsidiary. Assume that the Egyptian pound is the subsidiary's functional currency. tableCAYCE CORPORATIONT financial statements into US dollars and prepare a consolidation worksheet for Cayce and its Egyptian subsidiary. Assume that the Egyptian pound is the subsidiarys functional currency.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock