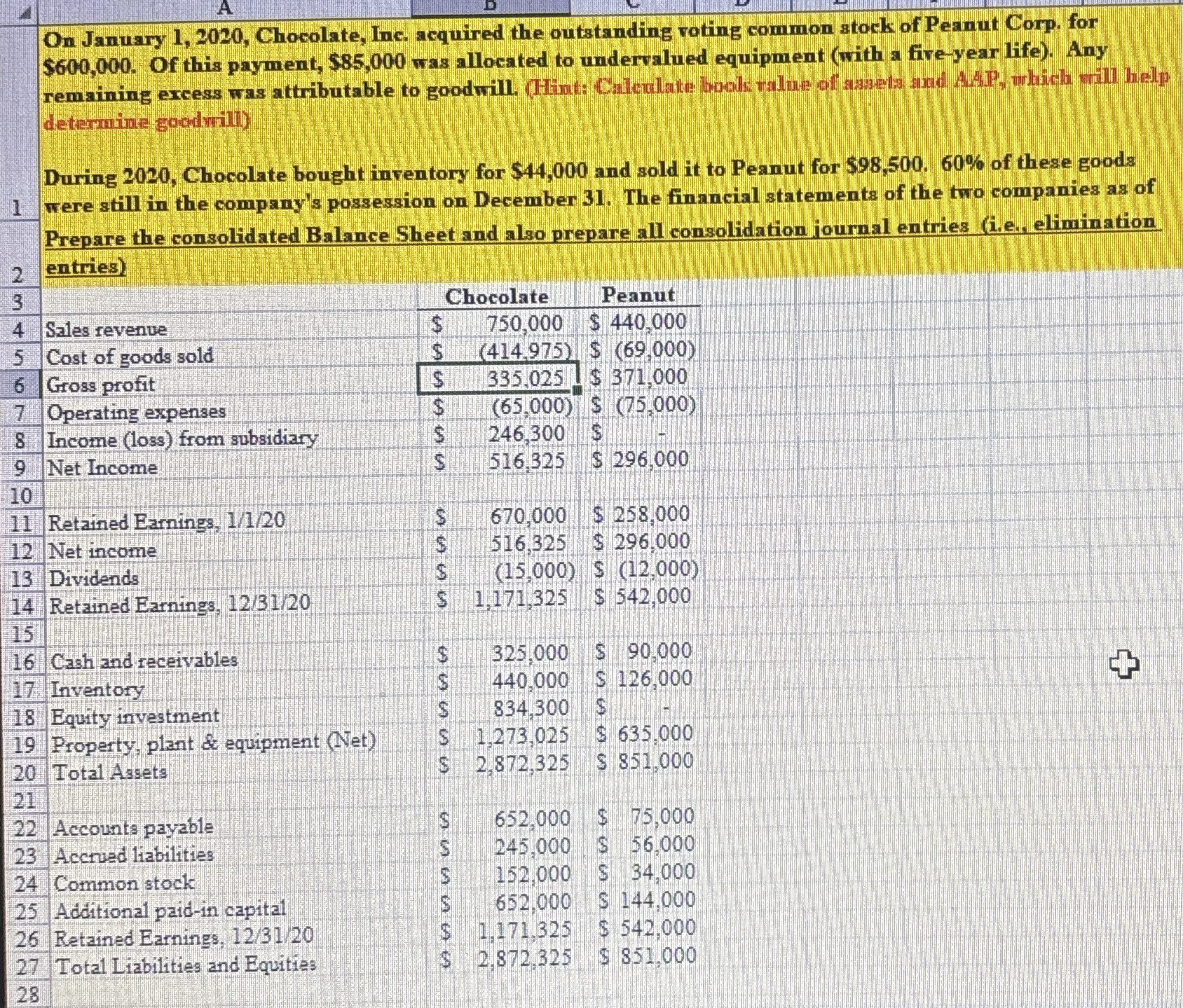

Question: On January 1 , 2 0 2 0 , Chocolate, Inc. acquired the outstanding voting common stock of Peanut Corp. for $ 6 0 0

On January Chocolate, Inc. acquired the outstanding voting common stock of Peanut Corp. for

$ Of this payment, $ was allocated to undervalued equipment with a fiveyear life Any

remaining excess was attributable to goodwill. HHints: Calculate boolk value of asacta and AAP, which mill help

deteraxime goodsill

During Chocolate bought inventory for $ and sold it to Peanut for $ of these goods

were still in the company's possession on December The financial statements of the two companies as of

Prepare the consolidated Balance Sheet and also prepare all consolidation journal entries ie elimination

entries

On January Chocolate, Inc. acquired the outstanding voting common stock of Peanut Corp, for

$ Of this payment, $ was allocated to undervalued equipment with a fiveyear life Any

remsining excess was attributable to goodwill. Hinut: Calculate bools value of sasgetas aud AAP, wrobichi will hielp

determine goodkill

During Chocolate bought inventory for $ and sold it to Peanut for $ of these goods

were still in the company's possession on December The financial statements of the two companies as of

Prepare the consolidated Balance Sheet and also prepare all consolidation journal entries ie elimination

entries

Accounts payable

Accrued liabilities

Common stock

Additional paidin capital

Retained Earnings,

Total Liabilities and Equities

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock