Question: On January 1 , 2 0 2 0 Devo Sciences, Inc. ( DSI ) and Lessee, Inc. sign a four year non - cancelable lease

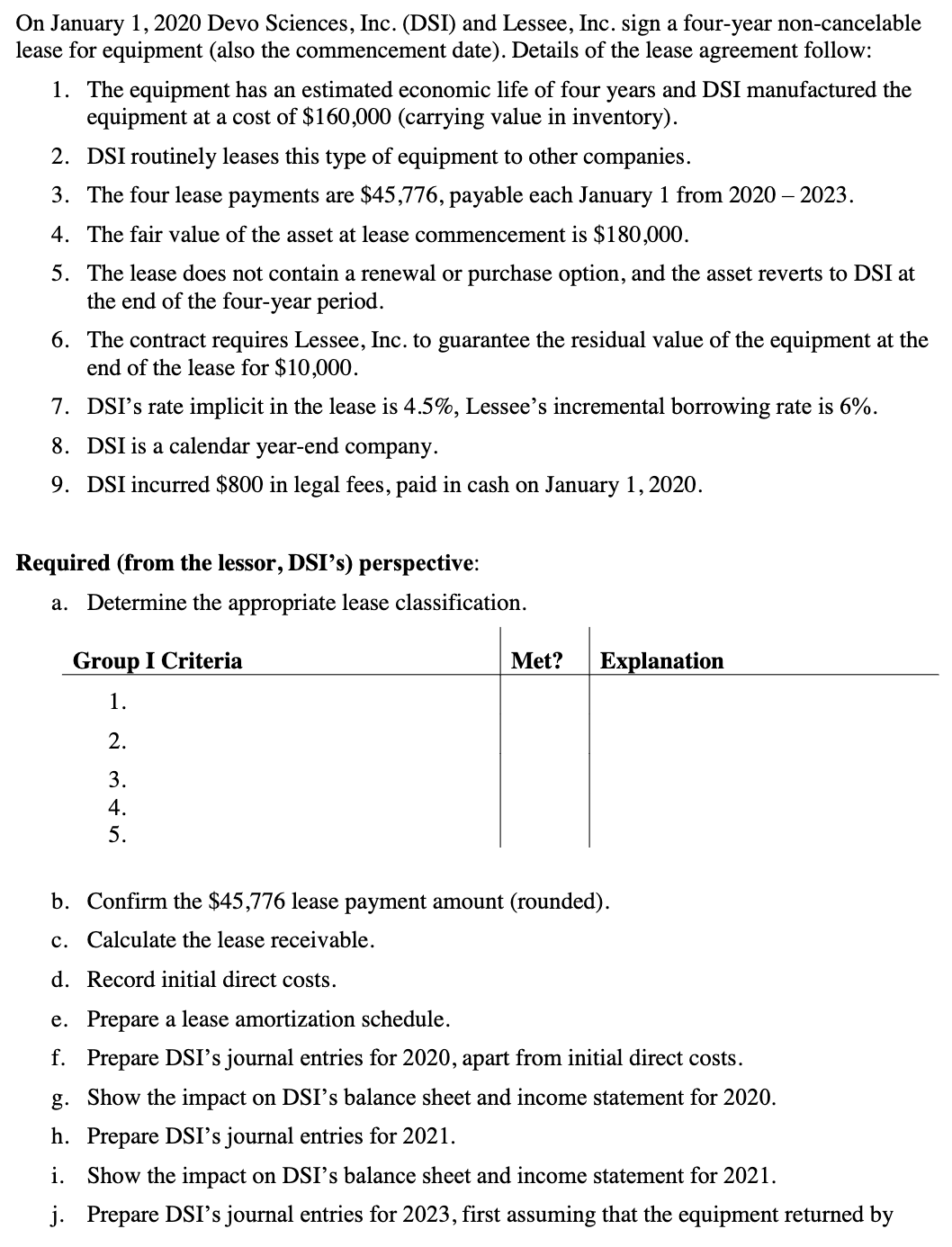

On January Devo Sciences, Inc. DSI and Lessee, Inc. sign a four year noncancelable lease for equipment also the commencement date Details of the lease agreement follow:

The equipment has an estimated economic life of four years and DSI manufactured the equipment at a cost of $carrying value in inventory

DSI routinely leases this type of equipment to other companies.

The four lease payments are $ payable each January from

The fair value of the asset at lease commencement is $

The lease does not contain a renewal or purchase option, and the asset reverts to DSI at the end of the fouryear period.

The contract requires Lessee, Inc. to guarantee the residual value of the equipment at the end of the lease for $

DSI's rate implicit in the lease is Lessee's incremental borrowing rate is

DSI is a calendar yearend company.

DSI incurred $ in legal fees, paid in cash on January

Required from the lessor, DSI's perspective:

a Determine the appropriate lease classification.

b Confirm the $ lease payment amount rounded

c Calculate the lease receivable.

d Record initial direct costs.

e Prepare a lease amortization schedule.

f Prepare DSI's journal entries for apart from initial direct costs.

g Show the impact on DSI's balance sheet and income statement for

h Prepare DSI's journal entries for

i Show the impact on DSI's balance sheet and income statement for

j Prepare DSI's journal entries for first assuming that the equipment returned by Lessee, Inc. had a fair value of $

k How would your answers to f and j above differ if the residual value were unguaranteed?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock