Question: On January 1 , 2 0 2 0 , Innovus, Inc., acquired 1 0 0 % of the common stock of ChipTech Company for $

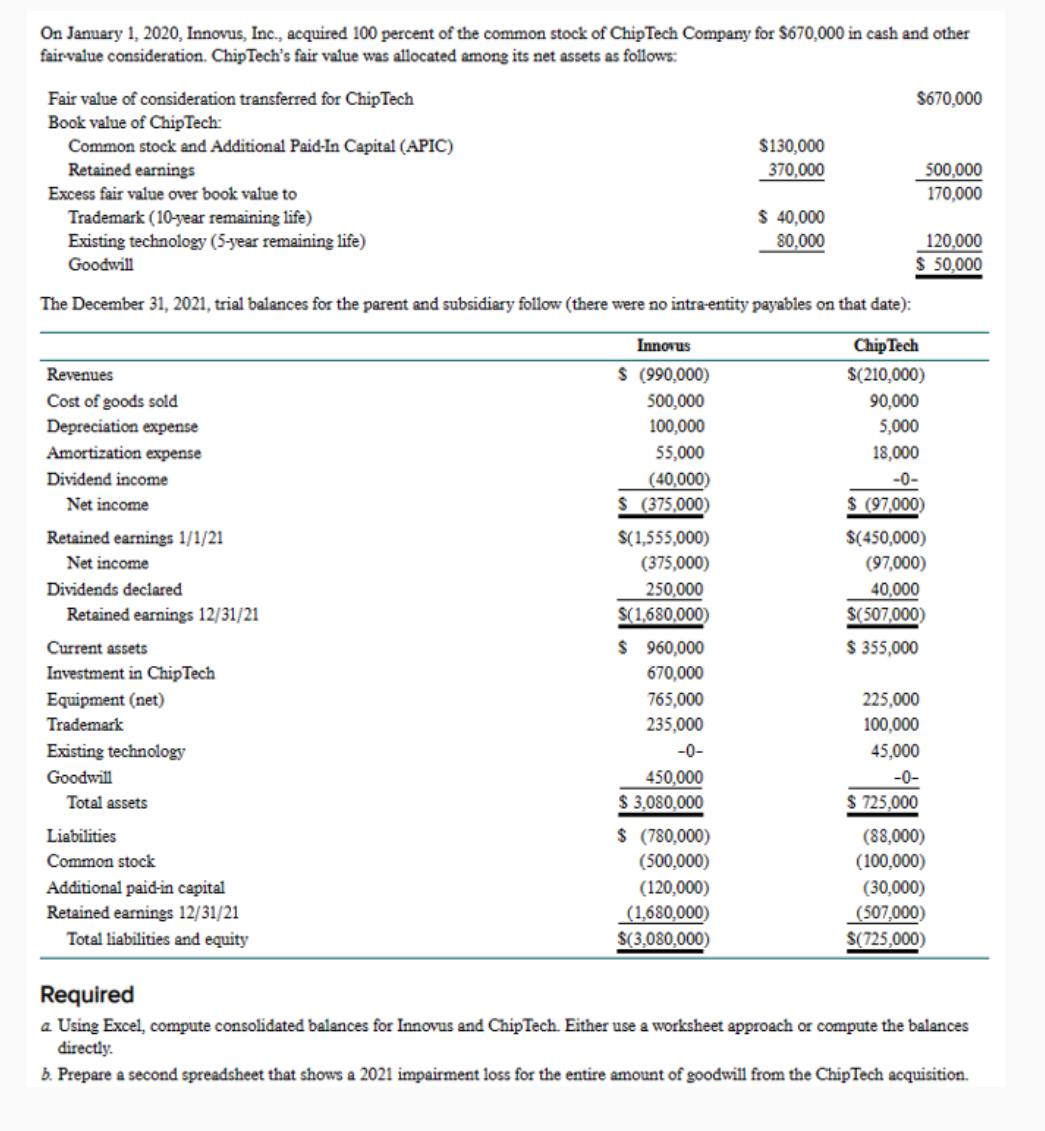

On January Innovus, Inc., acquired of the common stock of ChipTech Company for $ in cash and other fairvalue consideration. ChipTech's fair value was allocated among its net assets as follows.

Fair value of consideration transferred for ChipTech $

Book value of ChipTech:

Common stock and Additional PaidIn Capital APIC

Retained Earnings

Excess fair value over book value to

Trademark year remaining life

Existing technology year remaining life

Goodwill $

$

The December trial balances for the parent and subsidiary follow there were no intraentity payables on that date

Innovus ChipTech

Revenues $ $

Cost of goods sold

Depreciation expense

Amortization expense

Dividend income

Net income

$

$

Retained earnings

Net income

Dividends declared

Retained earnings $

$ $

$

Current assets $ $

Investment in ChipTech

Equipment net

Trademark

Existing technology

Goodwill

Total assets

$

$

Liabilities $

Common stock

Additional paidin capital

Retained earnings

Total liabilities and equity

$

$ On January Innovus, Inc., acquired percent of the common stock of ChipTech Company for $ in cash and other

fairvalue consideration. ChipTech's fair value was allocated among its net assets as follows:

Fair value of consideration transferred for ChipTech

$

Book value of ChipTech:

Common stock and Additional PaidIn Capital APIC

Retained earnings

Excess fair value over book value to

Trademark year remaining life

Existing technology year remaining life

Goodwill

The December trial balances for the parent and subsidiary follow there were no intraentity payables on that date:

Required

a Using Excel, compute consolidated balances for Innovus and ChipTech Either use a worksheet approach or compute the balances

directly.

PLEASE SHOW HOW TO ARRIVE AT ADJUSTMENTS,Why the adjustment. please NOT JUST THE NUMBERSanswers STRUGGLING ALOT TO UNDERSTAND, I HAVE AN UNDERSTANDING BUT STILL CONFUSED.AM STILL CONFUSED. HAVE AN UNDERSTANDING BUT AM STILL CONFUSED., I HAVE AN UNDERSTANDING BUT AM STILL CONFUSED.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock