Question: On January 1 , 2 0 2 0 , Mcllroy, Inc., acquired a 6 0 percent interest in the common stock of Stinson, Inc., for

On January Mcllroy, Inc., acquired a percent interest in the common stock of Stinson, Inc., for $ Stinson's book

value on that date consisted of common stock of $ and retained earnings of $ Also, the acquisitiondate fair value of

the percent noncontrolling interest was $ The subsidiary held patents with a year remaining life that were undervalued

within the company's accounting records by $ and an unrecorded customer list year remaining life assessed at a $

fair value. Any remaining excess acquisitiondate fair value was assigned to goodwill. Since acquisition, Mcllroy has applied the equity

method to its Investment in Stinson account and no goodwill impairment has occurred. At yearend, there are no intraentity payables

or receivables.

Intraentity inventory sales between the two companies have been made as follows:

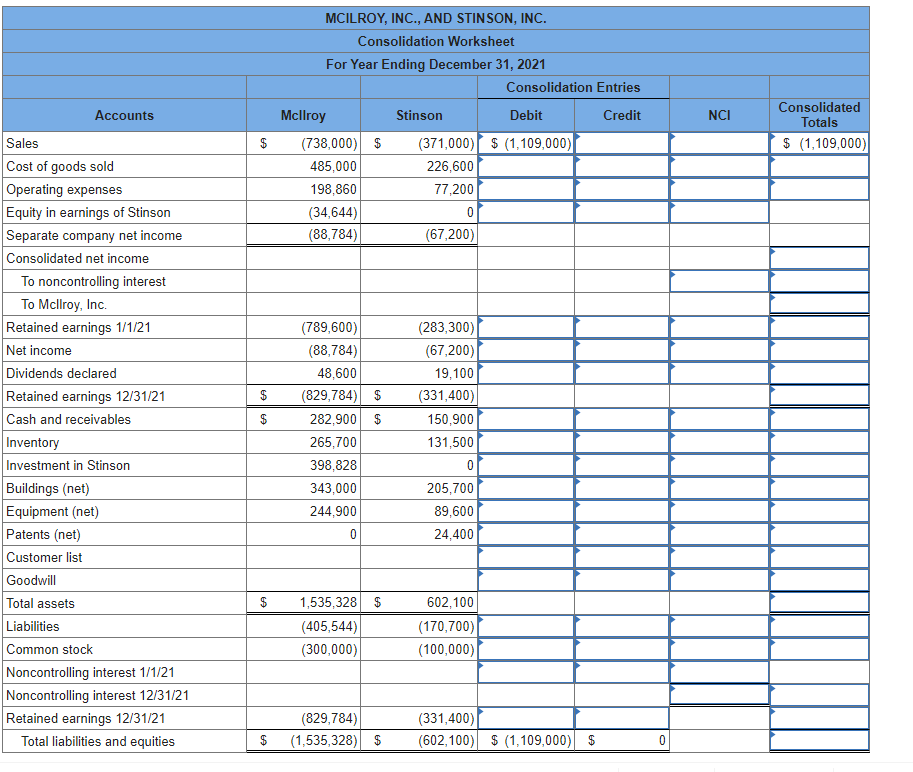

The individual financial statements for these two companies as of December and the year then ended follow:tableMCILROY INC., AND STINSON, INC.Consolidation WorksheetFor Year Ending December Mcllroy,Stinson,Consolidation Entries,tableConsolidatedTotalsAccountsDebit,CreditSales$$$$

Note: Parentheses indicate a credit balance.Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock