Question: On January 1 , 2 0 2 1 , Aurora Corporation ( Aurora ) acquired 8 8 % of the outstanding ordinary shares of Blossom

On January Aurora Corporation Aurora acquired of the outstanding ordinary shares of Blossom Limited Blossom amounting to shares, for $ million. Thereby, Aurora gained the control over Blossom. After the acquisition, Blossom operated as a nonwholly owned subsidiary of Aurora, which maintained its own legal and accounting identity. Following the acquisition, Aurora chose to use the cost method to account for its investment in Blossom in its financial statements, reflecting its ownership stake in the subsidiary.

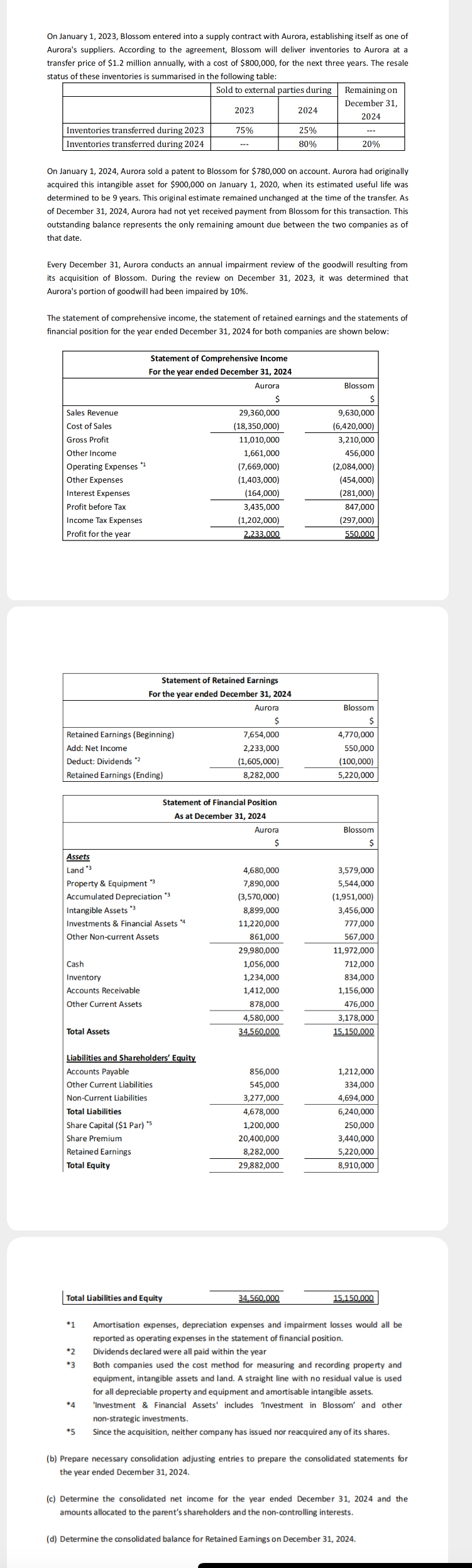

On January the shareholders' equity of Blossom included the following

Share Capital $ par $

Share Premium $

Retained Earnings $

In the consolidated financial statements, Aurora chose to apply the Partial Goodwill Method when reporting the noncontrolling interests. The remaining shares of Blossom continued to be actively traded in the open market at $ per share around the time of the acquisition. The fair value of the noncontrolling interests can be approximated by Blossom's share price on the acquisition date.

An appraisal of Blossom's assets and liabilities on January revealed that all book values appropriately reflected the fair values of Blossom's underlying accounts except for the following.

tableCarrying Amount,Fair Value,RemarkstableBuilding with acost of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock