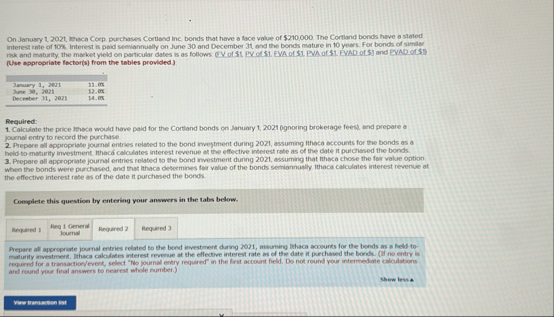

Question: On January 1 . 2 0 2 1 , Bhaca Coep purchases Cortiend inc bonds that have a face volue of $ 2 7 0

On January Bhaca Coep purchases Cortiend inc bonds that have a face volue of $ The Cortland bonds have a stated interest rate of Interest is paid semiannually on June and December and the bonds mature in years. For bonds of similar rek and matirity, the maket yield con particular dates is as follows: CVV of $ PV of $ FVA of $L PVA of $ EYAD of $ and PVAD of $Use appropriate factors from the tables provided

tableJamury June Decceter em

Required:

Calculate the price thaca would heve paid for the Cortland bonds on January Dgnoring brokerage feesh, and prepare a journal entry to recoed the purchase.

Prepare all appropriste journel entries related to the bond irvegtment during assuming litheca accoums for the bonds as a held tomaturity investment thecif calculates interest revenue at the effective inferest rate as of the date it purchased the bonds.

Prepare all appropnate journal entries related to the bond investment during assuming that lihba chose the fair value option when the bonds were purchased, and that thace determines far velue of the bonds semiannually ithaca calculates interest revenue at the effective interest rate as of the date it purchesed the bonds.

Complete this question by entering your anvwers in the tabs below.

Beq Genera loumal

Aepare all appropnate journal ertries redated to the bond ievestment daring maming lahaca accounts for the bonds as a held tomafurity investrment. Ithaca calculates interest reverue at the eflective interest rate as of the date if porchased the borvh. if no entry is requred for a transactionfevent, select No yournal entry required" in the frst account field. Do not round your intermediate calculations and reand yeor final answess to nearest whole number.

Shew lesse

Record the investment in bonds with a face value of $ a stated interest rate of and a market yield of The bonds pay interest semiannually.

Record the interest revenue.

Record the fair value adjustment when the market yield is

Record the interest revenue.

Record the fair value adjustment when the market yield is Record the investment in bonds with a face value of $ a stated interest rate of and a market yield of The bonds pay interest semiannually.

Record the interest revenue.

Record the fair value adjustment when the market yield is

Record the interest revenue.

Record the fair value adjustment when the market yield is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock