Question: On January 1 , 2 0 2 1 , Hickory Corporation signs a noncancelable contract in which it agrees to lease a piece of non

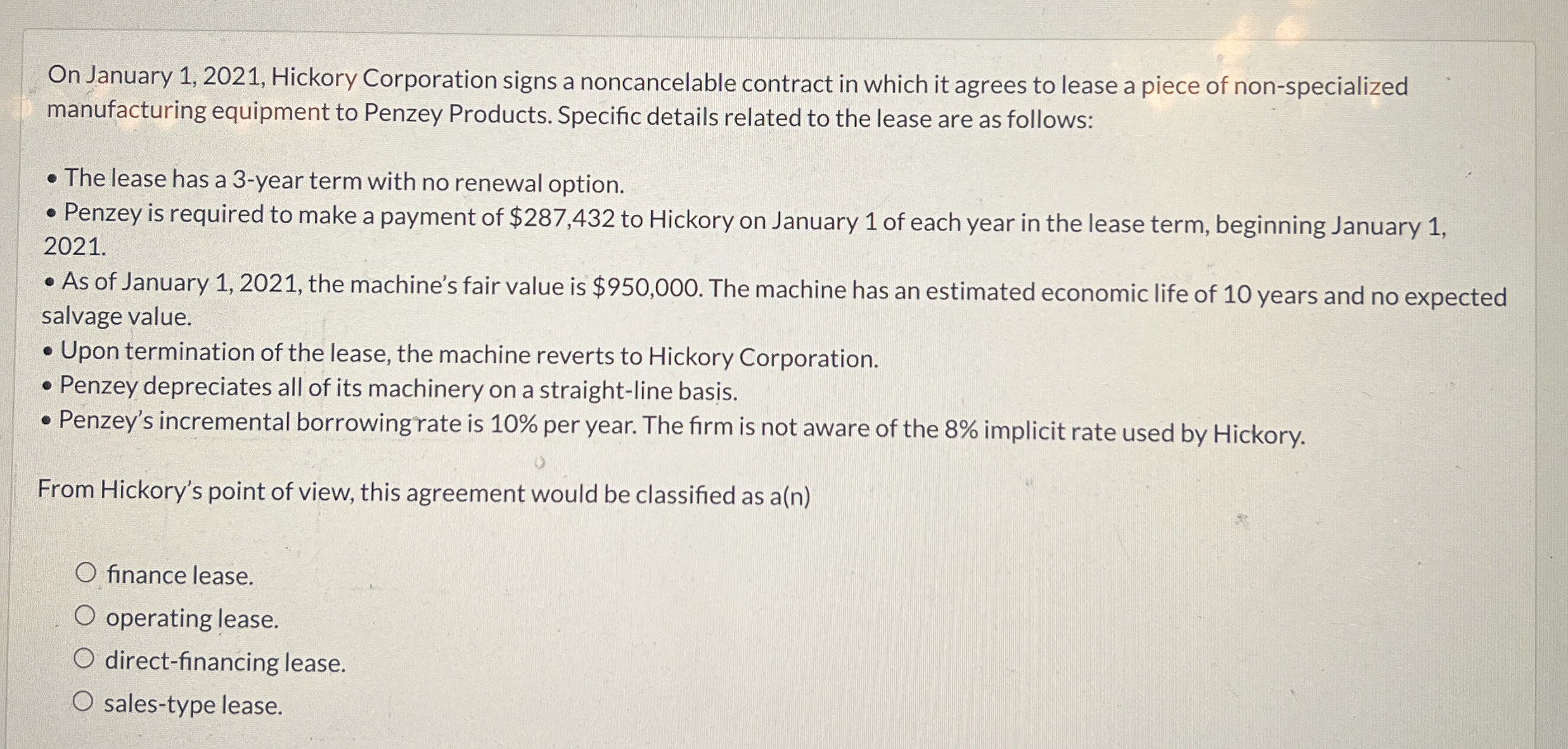

On January Hickory Corporation signs a noncancelable contract in which it agrees to lease a piece of nonspecialized manufacturing equipment to Penzey Products. Specific details related to the lease are as follows:

The lease has a year term with no renewal option.

Penzey is required to make a payment of $ to Hickory on January of each year in the lease term, beginning January

As of January the machine's fair value is $ The machine has an estimated economic life of years and no expected salvage value.

Upon termination of the lease, the machine reverts to Hickory Corporation.

Penzey depreciates all of its machinery on a straightline basis.

Penzey's incremental borrowingrate is per year. The firm is not aware of the implicit rate used by Hickory.

From Hickory's point of view, this agreement would be classified as an

finance lease.

operating lease.

directfinancing lease.

salestype lease.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock