Question: On January 1 , 2 0 2 1 , Moorecraft Finance Company agreed to lease a piece of machinery to Ward Construction Products, Inc. Moorecraft

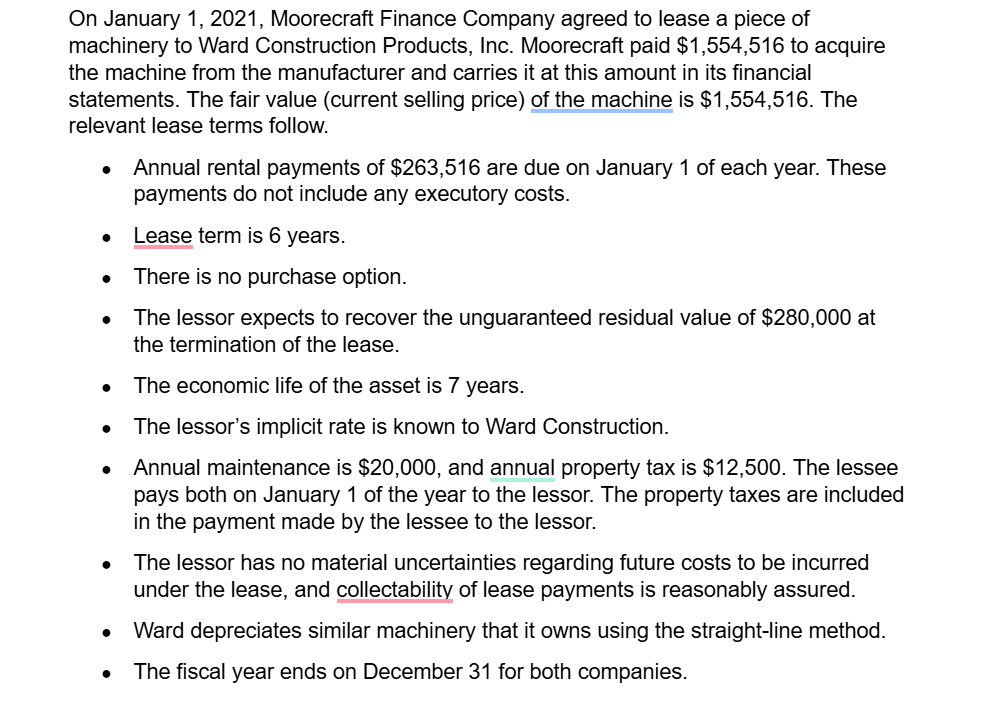

On January Moorecraft Finance Company agreed to lease a piece of machinery to Ward Construction Products, Inc. Moorecraft paid $ to acquire the machine from the manufacturer and carries it at this amount in its financial statements. The fair value current selling price of the machine is $ The relevant lease terms follow.

Annual rental payments of $ are due on January of each year. These payments do not include any executory costs.

Lease term is years.

There is no purchase option.

The lessor expects to recover the unguaranteed residual value of $ at the termination of the lease.

The economic life of the asset is years.

The lessors implicit rate is known to Ward Construction.

Annual maintenance is $ and annual property tax is $ The lessee pays both on January of the year to the lessor. The property taxes are included in the payment made by the lessee to the lessor.

The lessor has no material uncertainties regarding future costs to be incurred under the lease, and collectability of lease payments is reasonably assured.

Ward depreciates similar machinery that it owns using the straightline method.

The fiscal year ends on December for both companies.

Prepare the lessors journal entries required for each year of the lease term assuming that the equipment is returned with a fair value of $USE THE THE THREE LAST IMAGES, I NEED THE INFO FOR THEM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock