Question: On January 1 , 2 0 2 2 , Aspen Company acquired 8 0 percent of Birch Company's voting stock for $ 3 9 6

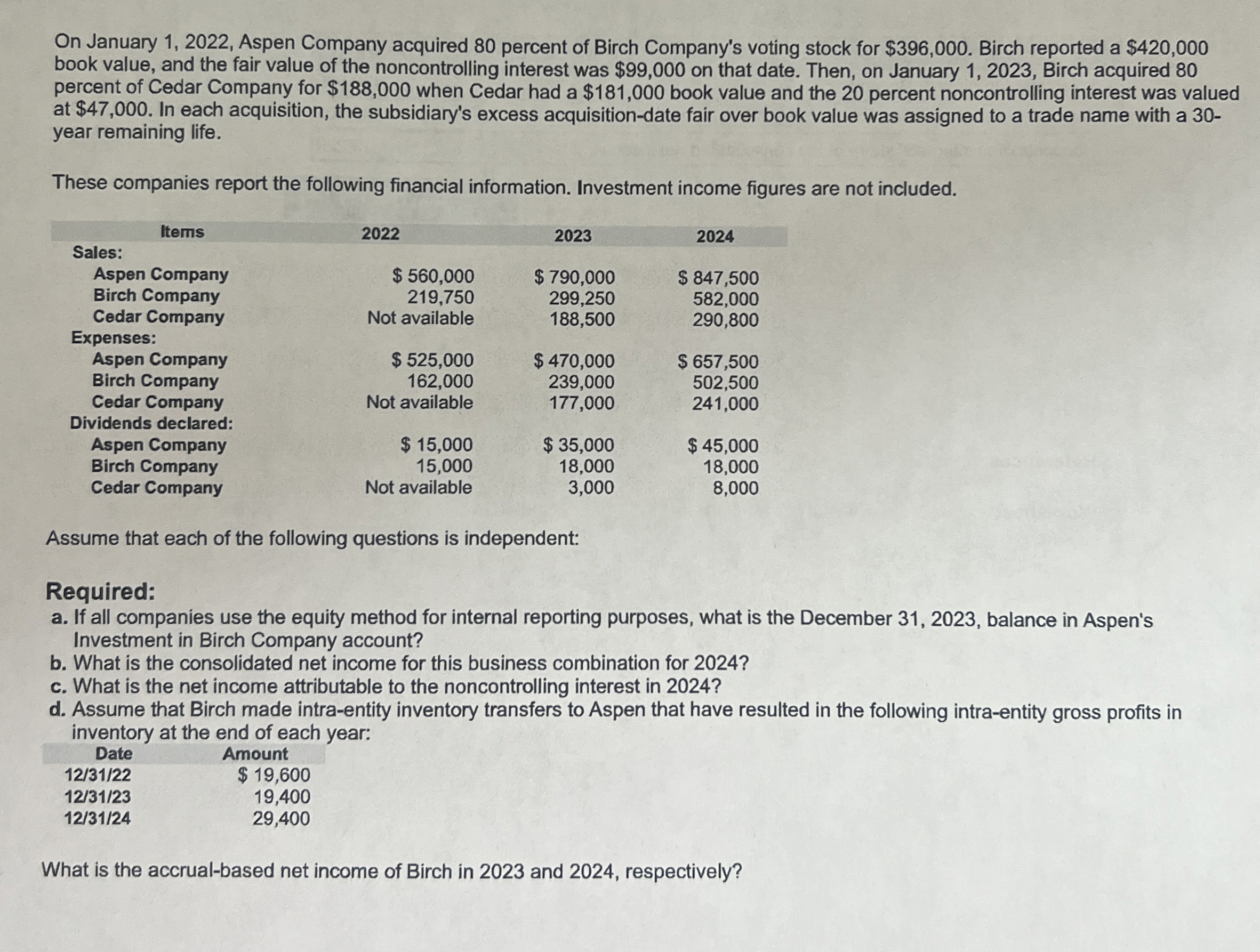

On January Aspen Company acquired percent of Birch Company's voting stock for $ Birch reported a $ book value, and the fair value of the noncontrolling interest was $ on that date. Then, on January Birch acquired percent of Cedar Company for $ when Cedar had a $ book value and the percent noncontrolling interest was valued at $ In each acquisition, the subsidiary's excess acquisitiondate fair over book value was assigned to a trade name with a year remaining life.

These companies report the following financial information. Investment income figures are not included.

tableIternsSales:Aspen Company,$ $ $ Birch Company,Cedar Company,Not available,Expenses:Aspen Company,$ $ $ Birch Company,Cedar Company,Not available,Dividends declared:Aspen Company,$ $ $ Birch Company,Cedar Company,Not available,

Assume that each of the following questions is independent:

Required:

a If all companies use the equity method for internal reporting purposes, what is the December balance in Aspen's Investment in Birch Company account?

b What is the consolidated net income for this business combination for

c What is the net income attributable to the noncontrolling interest in

d Assume that Birch made intraentity inventory transfers to Aspen that have resulted in the following intraentity gross profits in inventory at the end of each year:

tableDateAmount$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock