Question: On January 1 , 2 0 2 2 , Kismet Company acquired all of the outstanding stock of Palmer Company, a French firm at a

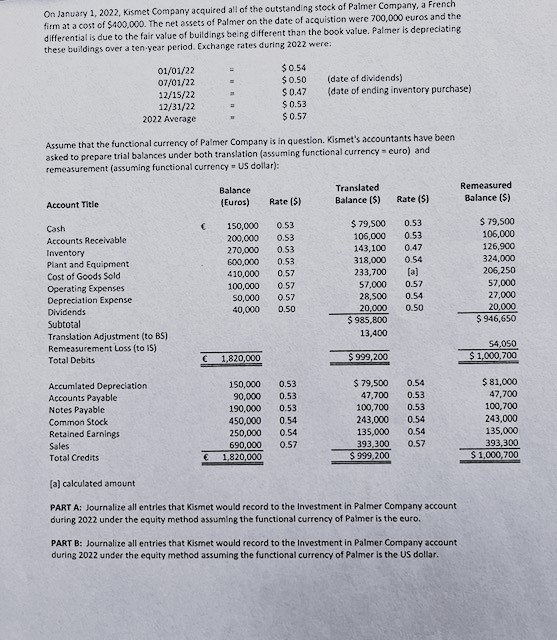

On January Kismet Company acquired all of the outstanding stock of Palmer Company, a French firm at a cost of $ The net assets of Palmer on the date of acquisition were euros and the differential is due to the fair value of buildings being different than the book value. Palmer is depreciating these buildings over a tenyear period. Exchange rates during were: DateRate $euroDescription$$date of dividends$date of ending inventory purchase Average$ Assume that the functional currency of Palmer Company is in question. Kismet's accountants have been asked to prepare trial balances under both translation assuming functional currency euro and remeasurement assuming functional currency US dollar: Account TitleBalance EurosRate $Translated Balance $Rate $Remeasured Balance $Cash$$Accounts ReceivableInventoryPlant and EquipmentCost of Goods SoldOperating ExpensesDepreciation ExpenseDividendsSubtotal$$Translation Adjustment to BSRemeasurement Loss to ISTotal Debits$$ Account TitleBalance EurosRate $Translated Balance $Rate $Remeasured Balance $Accumulated DepreciationAccounts PayableNotes PayableCommon StockRetained EarningsSalesTotal Credits$$a calculated amount PART A: Journalize all entries that Kismet would record to the Investment in Palmer Company account during under the equity method assuming the functional currency of Palmer is the euro. PART B: Journalize all entries that Kismet would record to the Investment in Palmer Company account during under the equity method assuming the functional currency of Palmer is the US dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock