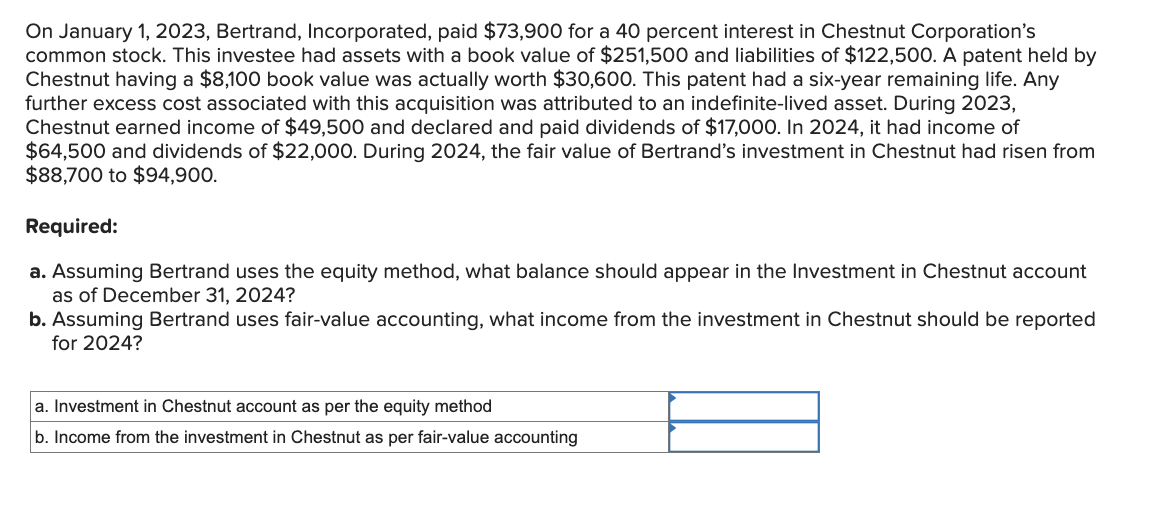

Question: On January 1 , 2 0 2 3 , Bertrand, Incorporated, paid $ 7 3 , 9 0 0 for a 4 0 percent interest

On January Bertrand, Incorporated, paid $ for a percent interest in Chestnut Corporation's

common stock. This investee had assets with a book value of $ and liabilities of $ A patent held by

Chestnut having a $ book value was actually worth $ This patent had a sixyear remaining life. Any

further excess cost associated with this acquisition was attributed to an indefinitelived asset. During

Chestnut earned income of $ and declared and paid dividends of $ In it had income of

$ and dividends of $ During the fair value of Bertrand's investment in Chestnut had risen from

$ to $

Required:

a Assuming Bertrand uses the equity method, what balance should appear in the Investment in Chestnut account

as of December

b Assuming Bertrand uses fairvalue accounting, what income from the investment in Chestnut should be reported

for

a Investment in Chestnut account as per the equity method

b Income from the investment in Chestnut as per fairvalue accounting

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock