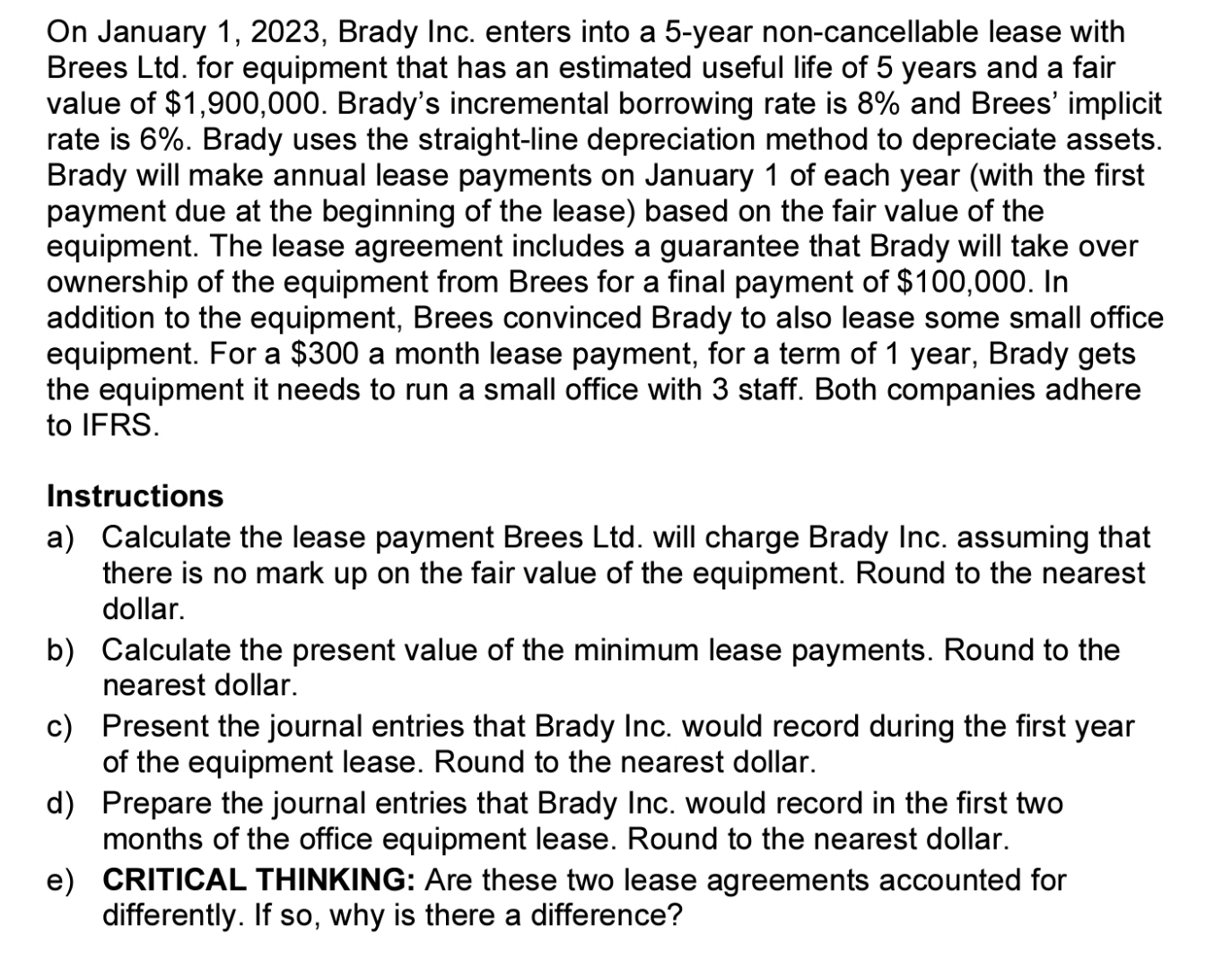

Question: On January 1 , 2 0 2 3 , Brady Inc. enters into a 5 - year non - cancellable lease with Brees Ltd .

On January Brady Inc. enters into a year noncancellable lease with

Brees Ltd for equipment that has an estimated useful life of years and a fair

value of $ Brady's incremental borrowing rate is and Brees' implicit

rate is Brady uses the straightline depreciation method to depreciate assets.

Brady will make annual lease payments on January of each year with the first

payment due at the beginning of the lease based on the fair value of the

equipment. The lease agreement includes a guarantee that Brady will take over

ownership of the equipment from Brees for a final payment of $ In

addition to the equipment, Brees convinced Brady to also lease some small office

equipment. For a $ a month lease payment, for a term of year, Brady gets

the equipment it needs to run a small office with staff. Both companies adhere

to IFRS.

Instructions

a Calculate the lease payment Brees Ltd will charge Brady Inc. assuming that

there is no mark up on the fair value of the equipment. Round to the nearest

dollar.

b Calculate the present value of the minimum lease payments. Round to the

nearest dollar.

c Present the journal entries that Brady Inc. would record during the first year

of the equipment lease. Round to the nearest dollar.

d Prepare the journal entries that Brady Inc. would record in the first two

months of the office equipment lease. Round to the nearest dollar.

e CRITICAL THINKING: Are these two lease agreements accounted for

differently. If so why is there a difference?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock