Question: On January 1 , 2 0 2 3 , Caroline Lampron and Jenni Meno formed a computer sales and service enterprise in Montreal by investing

On January Caroline Lampron and Jenni Meno formed a computer sales and service enterprise in Montreal by investing

$ cash. The new company, Pronghorn Sales and Service, had the following transactions in January:

Paid $ in advance for three months' rent of office, showroom, and repair space.

Purchased personal computers at a cost of $ each, six graphics computers at a cost of $ each, and printers

at a cost of $ each, paying cash on delivery.

Sales, repair, and office employees earned $ in salaries during January, of which $ was still payable at the end of

January.

Sold personal computers for $ each, four graphics computers for $ each, and printers for $ each. Of the

sales amounts, $ was received in cash in January and $ was sold on a deferred payment plan.

Other operating expenses of $ were incurred and paid for during January; $ of incurred expenses were payable

at January

a

Your answer is partially correct.

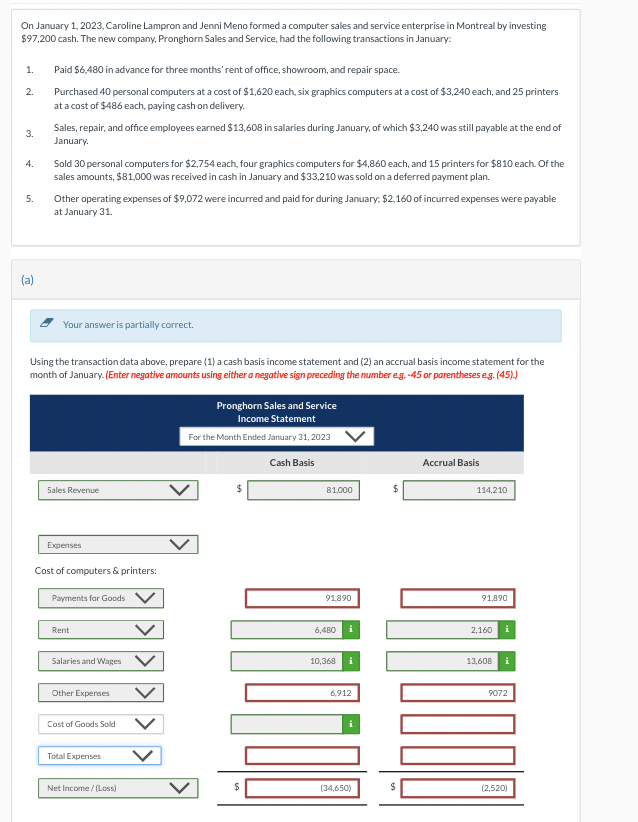

Using the transaction data above, prepare a cash basis income statement and an accrual basis income statement for the

month of January. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock