Question: On January 1 , 2 0 2 3 , Culver Corp. had 2 3 3 , 0 0 0 common shares outstanding. On April 1

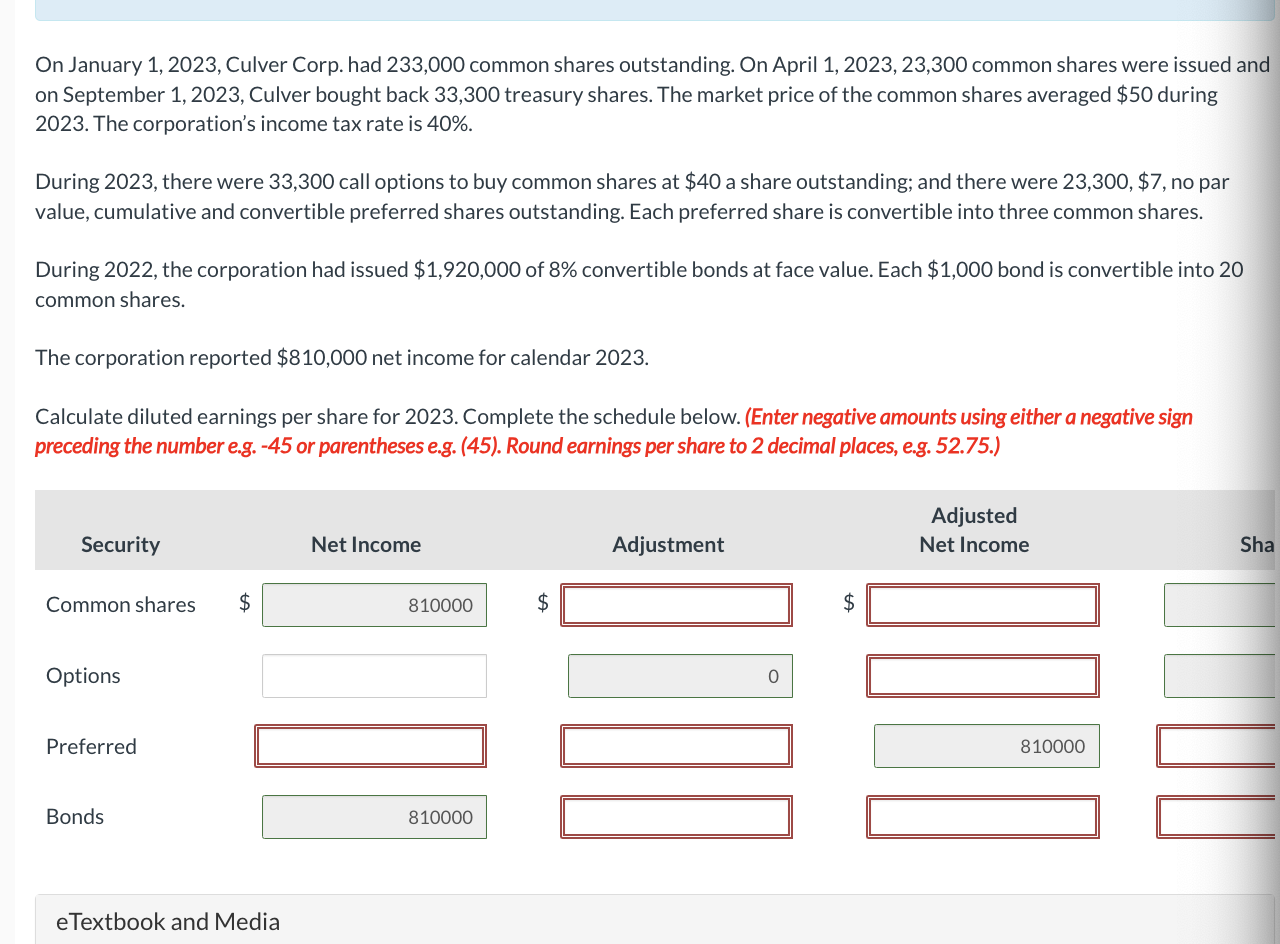

On January Culver Corp. had common shares outstanding. On April common shares were issued and on September Culver bought back treasury shares. The market price of the common shares averaged $ during The corporation's income tax rate is

During there were call options to buy common shares at $ a share outstanding; and there were $ no par value, cumulative and convertible preferred shares outstanding. Each preferred share is convertible into three common shares.

During the corporation had issued $ of convertible bonds at face value. Each $ bond is convertible into common shares.

The corporation reported $ net income for calendar

Calculate diluted earnings per share for Complete the schedule below. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg Round earnings per share to decimal places, eg Calculate diluted earnings per share for Complete the schedule below. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg Round earnings per share to decimal places, eg On January Culver Corp. had common shares outstanding. On April common shares were issued and on September Culver bought back treasury shares. The market price of the common shares averaged $ during The corporation's income tax rate is

During there were call options to buy common shares at $ a share outstanding; and there were $ no par value, cumulative and convertible preferred shares outstanding. Each preferred share is convertible into three common shares.

During the corporation had issued $ of convertible bonds at face value. Each $ bond is convertible into common shares.

The corporation reported $ net income for calendar

Calculate diluted earnings per share for Complete the schedule below. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg Round earnings per share to decimal places, egbegintabularcccccc

hline & Shares & Adjustment & Adjusted Shares & multicolumncEPS

hline & & & & $ &

hline & & & & &

hline & & & & &

hline & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock