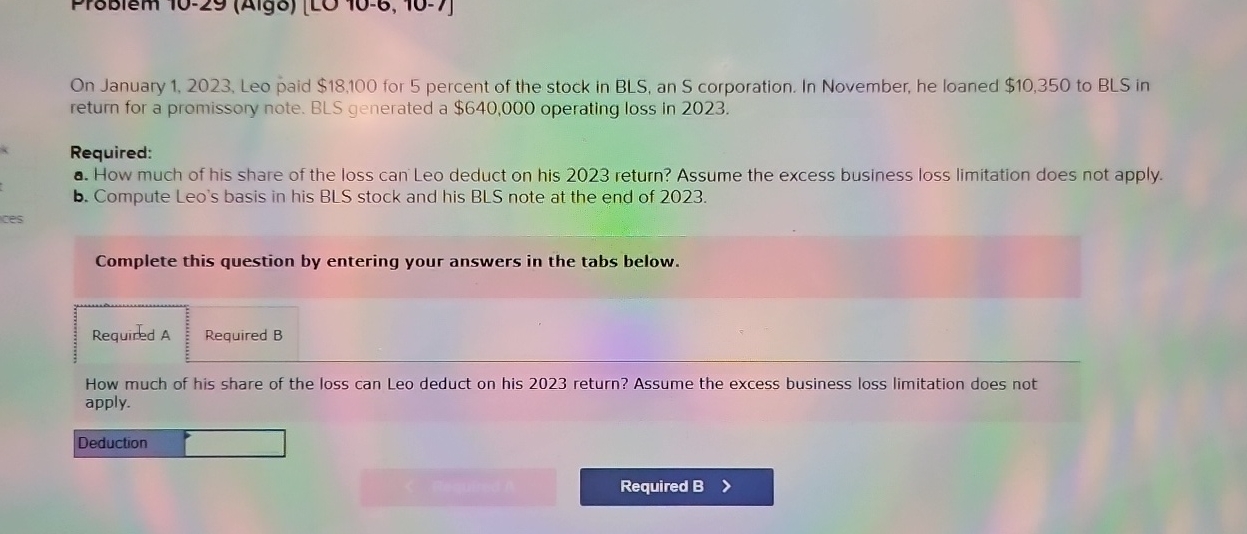

Question: On January 1 , 2 0 2 3 , Leo paid $ 1 8 , 1 0 0 for 5 percent of the stock in

On January Leo paid $ for percent of the stock in BLS an S corporation. In November, he loaned $ to BLS in return for a promissory note. BLS generated a $ operating loss in

Required:

a How much of his share of the loss can Leo deduct on his return? Assume the excess business loss limitation does not apply.

b Compute Leo's basis in his BLS stock and his BLS note at the end of

Complete this question by entering your answers in the tabs below.

Requirded

How much of his share of the loss can Leo deduct on his return? Assume the excess business loss limitation does not apply.

Deduction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock