Question: On January 1 , 2 0 2 3 , Mona, Incorporated, acquired 9 0 percent of Lisa Company's common stock as well as 7 0

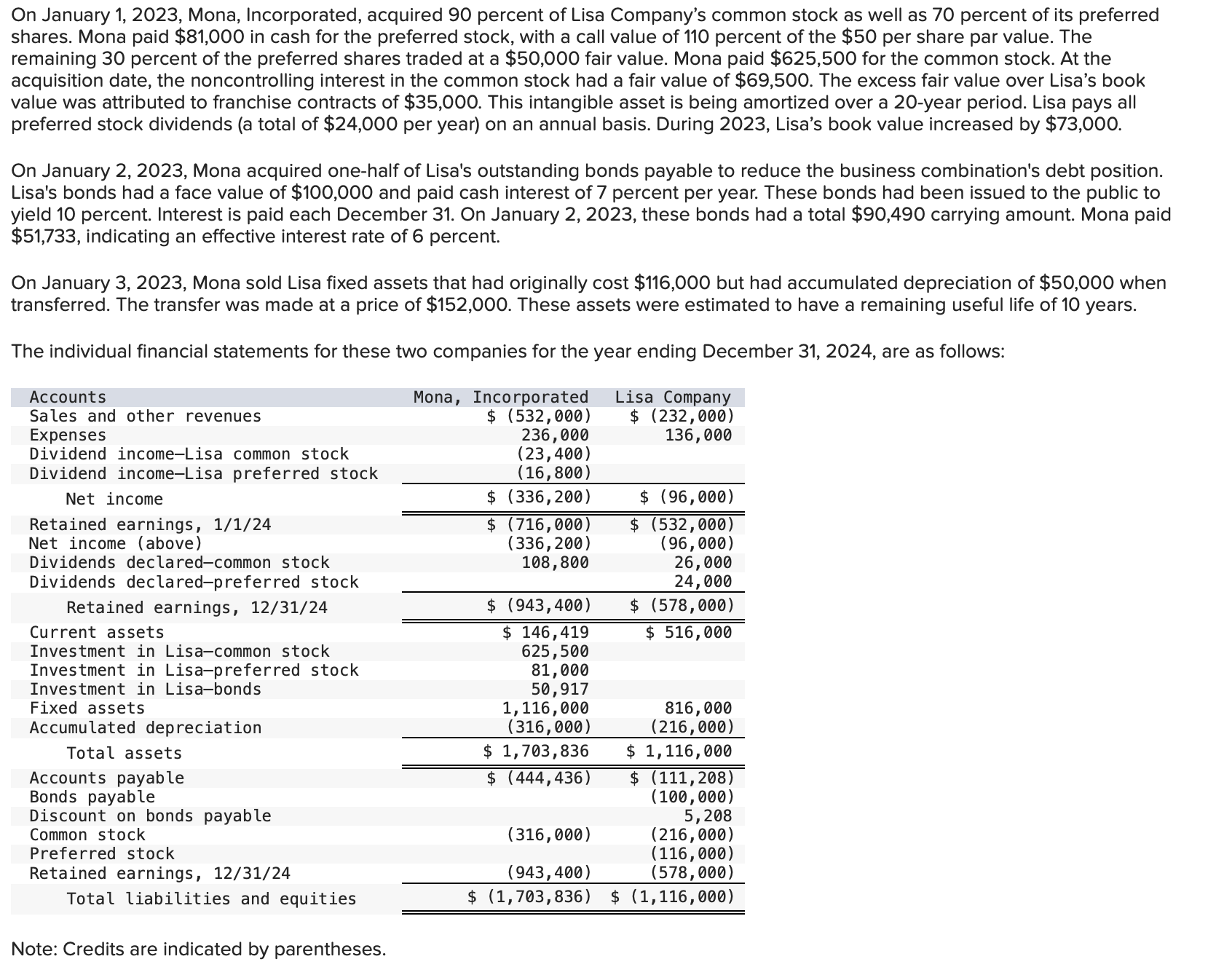

On January Mona, Incorporated, acquired percent of Lisa Company's common stock as well as percent of its preferred shares. Mona paid $ in cash for the preferred stock, with a call value of percent of the $ per share par value. The remaining percent of the preferred shares traded at a $ fair value. Mona paid $ for the common stock. At the acquisition date, the noncontrolling interest in the common stock had a fair value of $ The excess fair value over Lisa's book value was attributed to franchise contracts of $ This intangible asset is being amortized over a year period. Lisa pays all preferred stock dividends a total of $ per year on an annual basis. During Lisa's book value increased by $

On January Mona acquired onehalf of Lisa's outstanding bonds payable to reduce the business combination's debt position. Lisa's bonds had a face value of $ and paid cash interest of percent per year. These bonds had been issued to the public to yield percent. Interest is paid each December On January these bonds had a total $ carrying amount. Mona paid $ indicating an effective interest rate of percent.

On January Mona sold Lisa fixed assets that had originally cost $ but had accumulated depreciation of $ when transferred. The transfer was made at a price of $ These assets were estimated to have a remaining useful life of years.

The individual financial statements for these two companies for the year ending December are as follows:

Note: Credits are indicated by parentheses. Note: Credits are indicated by parentheses.

Required:

a What consolidation worksheet adjustments would have been required as of January to eliminate the subsidiary's common and preferred stocks?

b What consolidation worksheet adjustments would have been required as of December to account for Mona's purchase of Lisa's bonds?

c What consolidation worksheet adjustments would have been required as of December to account for the intraentity sale of fixed assets?

d Assume that consolidated financial statements are being prepared for the year ending December Calculate the consolidated balance for each of the following accounts:

Franchises

Fixed Assets

Accumulated Depreciation

Expenses Req A to C

a What consolidation worksheet adjustments would have been required as of January to eliminate the subsidiary's common and preferred stocks?

b What consolidation worksheet adjustments would have been required as of December to account for Mona's purchase of Lisa's bonds?

c What consolidation worksheet adjustments would have been required as of December to account for the intraentity sale of fixed assets?

Note: For all requirements, if no entry is required for a transactionevent select No journal entry required" in the first account field. Round your intermediate calculations and final answers to the nearest whole dollar amount.

Show less

begintabularcccccc

hline No & Date & multicolumnlAccounts & Debit & Credit

hline & S and A & Preferred stock Lisa & V & &

hline & & Common stock Lisa & V & &

hline & & Retained earnings Lisa & V & &

hline & & Franchises & v & &

hline & & Investment in LisaCommon stock & & &

hline & & Investment in LisaPreferred stock & V & &

hline & & Noncontrolling interest in Lisa & V & &

hline & & & & &

hline & B & Bonds payable & cdot & &

hline & & Interest income & v & &

hline & & Loss on retirement of bonds & V & &

hline & & Discount on bonds payable & v & &

hline & & Interest expense & V & &

hline & & Investment in Lisabonds & V & &

hline & & & & &

hline & TA & Gain on transfer of fixed assets & V & &

hline & & Accumulated depreciation & & &

hline & & Depreciation expense & V & &

hline & & Fixed assets & V & &

hline

endtabular

Assume that consolidated financial statements are being prepared for the year ending December Calculate the consolidated balance for each of the following accounts:

Note: Round your intermediate calculations and final answers to the nearest dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock