Question: On January 1 , 2 0 2 3 , Payne Company bought a 1 5 percent interest in Scout Company. The acquisition price of $

On January Payne Company bought a percent interest in Scout Company. The acquisition price of $ reflected an assessment that all of Scouts accounts were fairly valued within the companys accounting records. During Scout reported net income of $ and declared cash dividends of $ Payne possessed the ability to significantly influence Scouts operations and, therefore, accounted for this investment using the equity method.

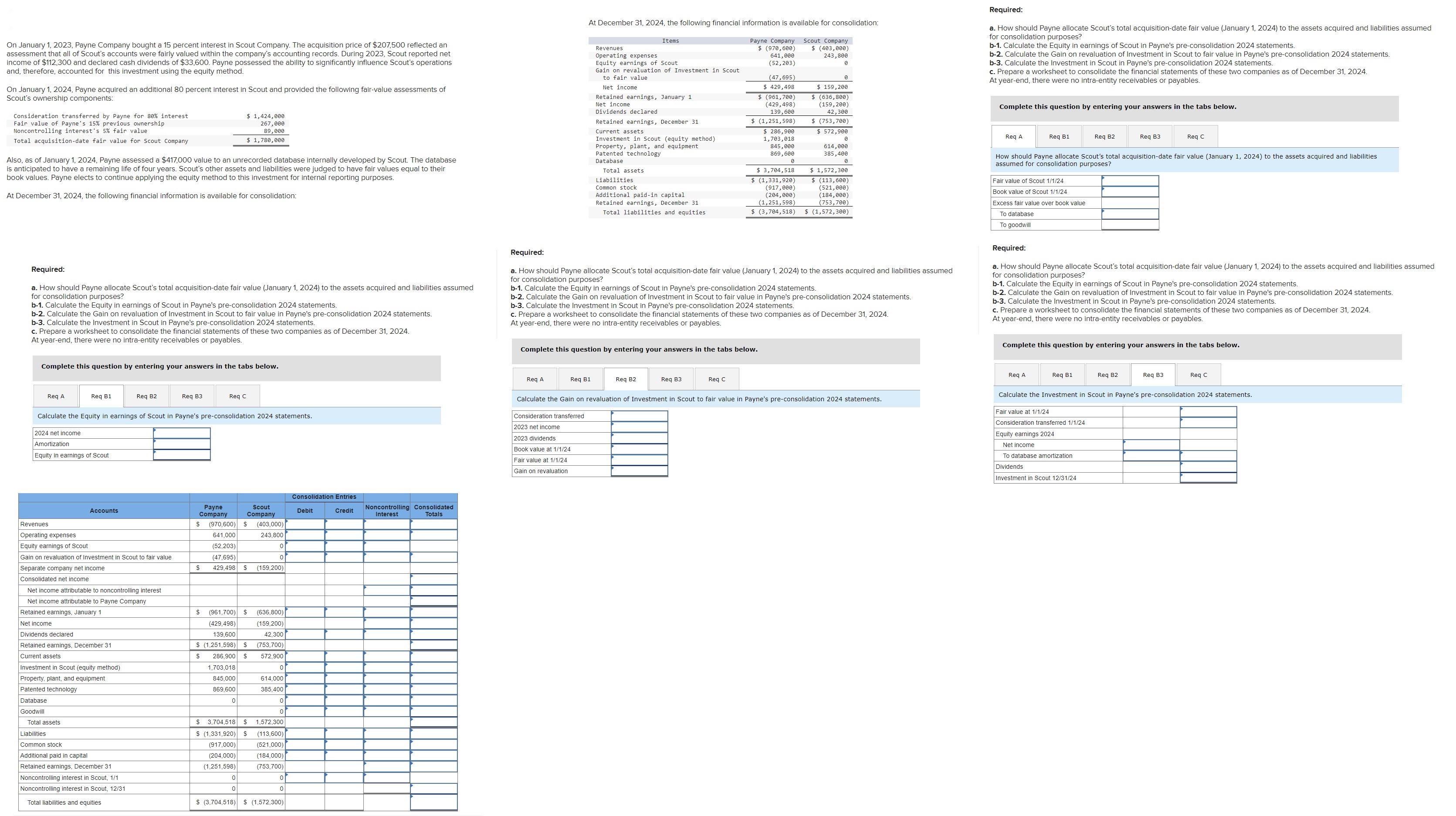

On January Payne acquired an additional percent interest in Scout and provided the following fairvalue assessments of Scouts ownership components:

Consideration transferred by Payne for interest $

Fair value of Payne's previous ownership

Noncontrolling interest's fair value

Total acquisitiondate fair value for Scout Company $

Also, as of January Payne assessed a $ value to an unrecorded database internally developed by Scout. The database is anticipated to have a remaining life of four years. Scouts other assets and liabilities were judged to have fair values equal to their book values. Payne elects to continue applying the equity method to this investment for internal reporting purposes.

At December the following financial information is available for consolidation:

Items Payne Company Scout Company

Revenues $ $

Operating expenses

Equity earnings of Scout

Gain on revaluation of Investment in Scout to fair value

Net income $ $

Retained earnings, January $ $

Net income

Dividends declared

Retained earnings, December $ $

Current assets $ $

Investment in Scout equity method

Property, plant, and equipment

Patented technology

Database

Total assets $ $

Liabilities $ $

Common stock

Additional paidin capital

Retained earnings, December

Total liabilities and equities $ $

Required:

a How should Payne allocate Scouts total acquisitiondate fair value January to the assets acquired and liabilities assumed for consolidation purposes?

b Calculate the Equity in earnings of Scout in Payne's preconsolidation statements.

b Calculate the Gain on revaluation of Investment in Scout to fair value in Payne's preconsolidation statements.

b Calculate the Investment in Scout in Payne's preconsolidation statements.

c Prepare a worksheet to consolidate the financial statements of these two companies as of December

At yearend, there were no intraentity receivables or payables.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock