Question: On January 1 , 2 0 2 3 , Roper Inc. agrees to buy 3 kg of gold at $ 4 0 , 0 0

On January Roper Inc. agrees to buy kg of gold at $ per kilogram from Golden Corp. on April but does not intend to take delivery of the gold. On the day that the contract was entered into, the fair value of this forward contract was zero. The fair value of the forward subsequently fluctuated as follows:

Date

Fair Value of Forward Contract

January

$

February

February

March

On the settlement date, the spot price of gold is $ per kilogram. Assume that Roper complies with IFS.

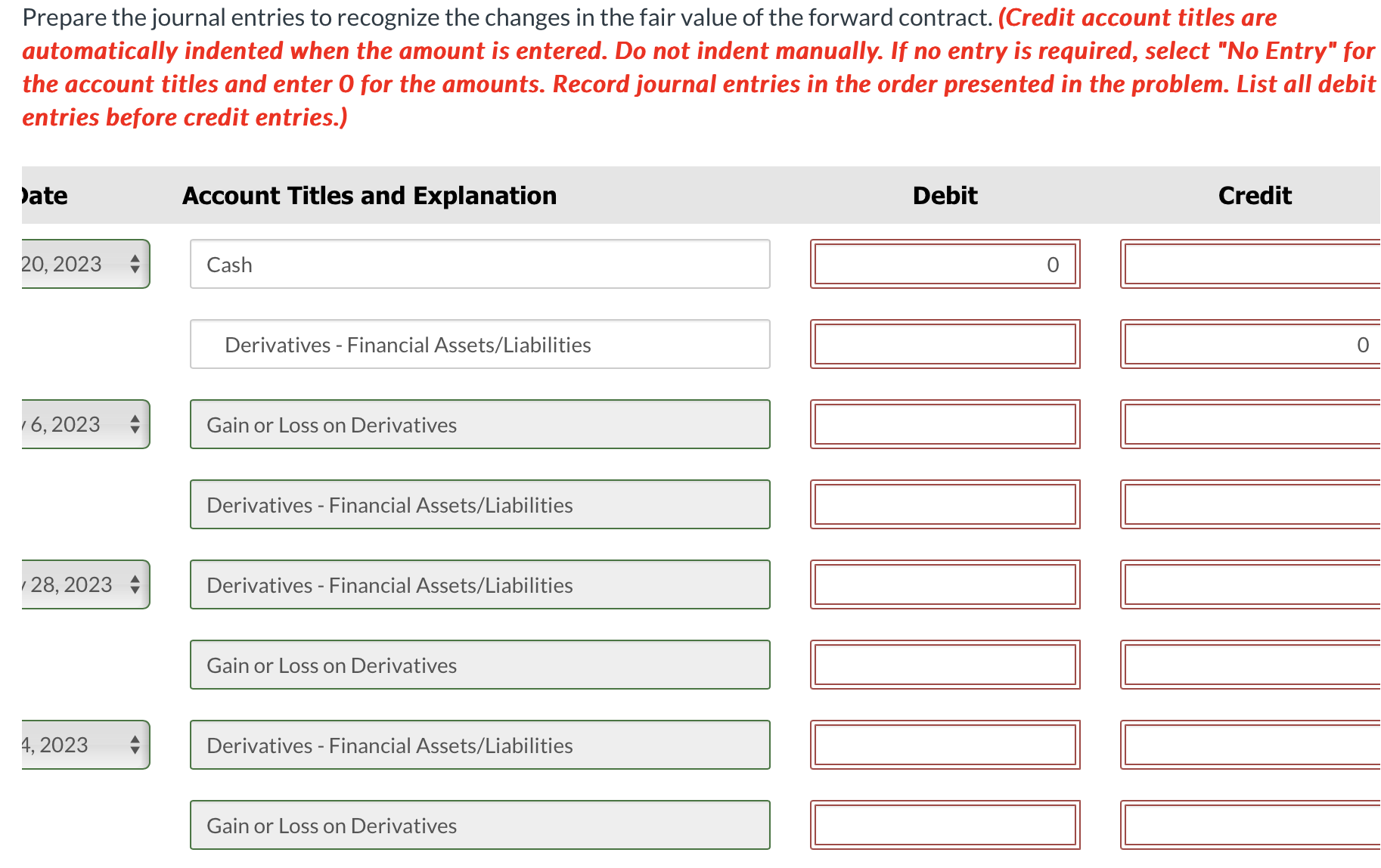

Prepare the journal entries to recognize the changes in the fair value of the forward contract. Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for

the account titles and enter for the amounts. Record journal entries in the order presented in the problem. List all debit

entries before credit entries.

Derivatives Financial AssetsLiabilities

Gain or Loss on Derivatives

Derivatives Financial AssetsLiabilities

Derivatives Financial AssetsLiabilities

Gain or Loss on Derivatives

Derivatives Financial AssetsLiabilities

Gain or Loss on Derivatives

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock