Question: On January 1 , 2 0 2 4 , Advanced Airlines purchased a used airplane for $ 4 8 , 5 0 0 , 0

On January Advanced Airlines purchased a used airplane for $ Advanced Airlines expects the plane to remain useful for four years miles and to have a residual value of $ The company expects the plane to be flown miles during the first year.

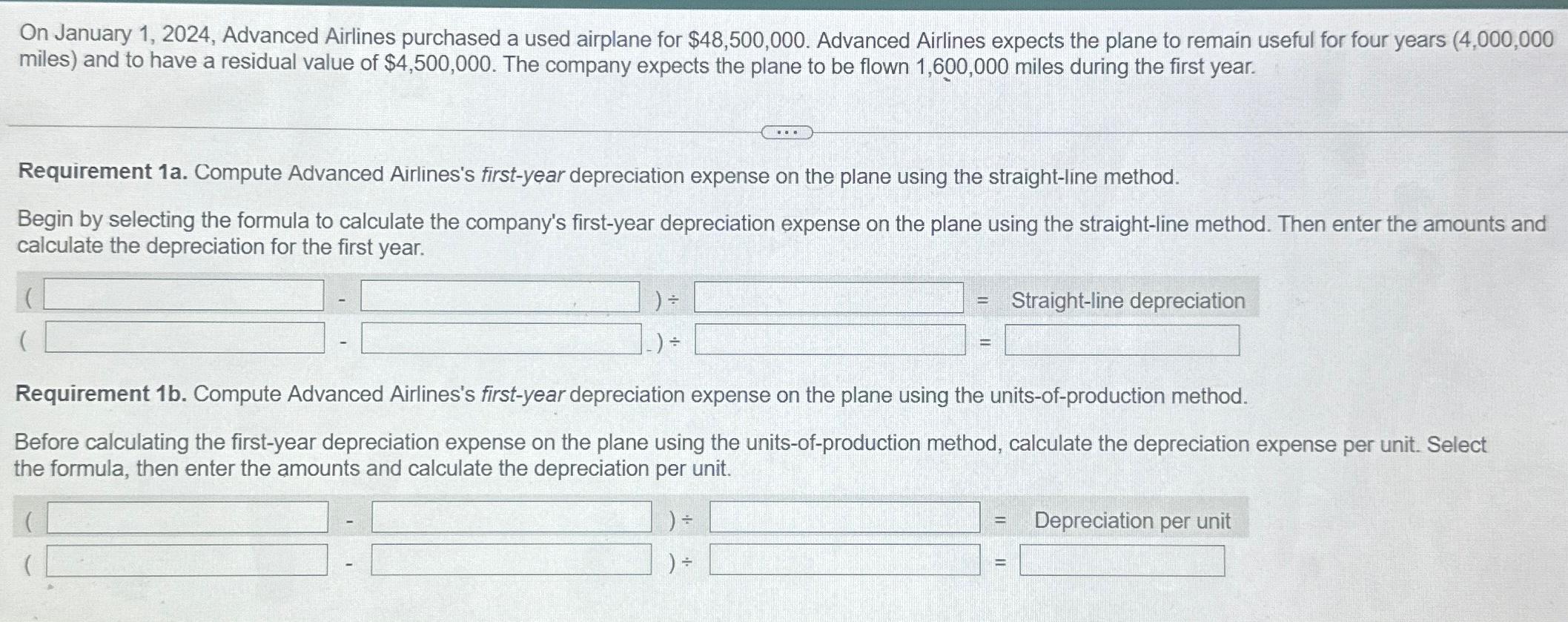

Requirement a Compute Advanced Airlines's firstyear depreciation expense on the plane using the straightline method.

Begin by selecting the formula to calculate the company's firstyear depreciation expense on the plane using the straightline method. Then enter the amounts and calculate the depreciation for the first year.

Requirement b Compute Advanced Airlines's firstyear depreciation expense on the plane using the unitsofproduction method.

Before calculating the firstyear depreciation expense on the plane using the unitsofproduction method, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation per unit.

tableDepreciation per unit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock