Question: On January 1 , 2 0 2 4 , Cooper Tree Company ( CTC ) purchases a copper mine for 1 7 , 5 0

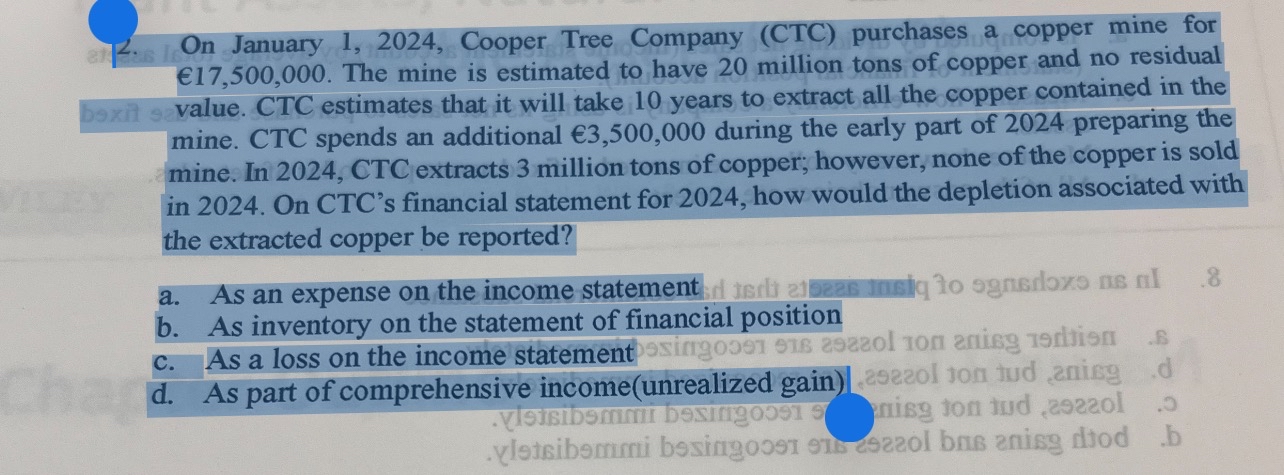

On January Cooper Tree Company CTC purchases a copper mine for The mine is estimated to have million tons of copper and no residual poxit s value. CTC estimates that it will take years to extract all the copper contained in the mine. CTC spends an additional during the early part of preparing the mine. In CTC extracts million tons of copper; however, none of the copper is sold in On CTCs financial statement for how would the depletion associated with the extracted copper be reported?

a As an expense on the income statement

b As inventory on the statement of financial position

c As a loss on the income statement sximgos ion anisg rluisn

d As part of comprehensive incomeunrealized gain jon tud anicg

vletsibemmi bsimgoest s eszzol bne znisg dtod b

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock