Question: On January 1 , 2 0 2 4 , Jay Company acquired all the outstanding ownership shares of Zee Company. In assessing Zee s acquisition

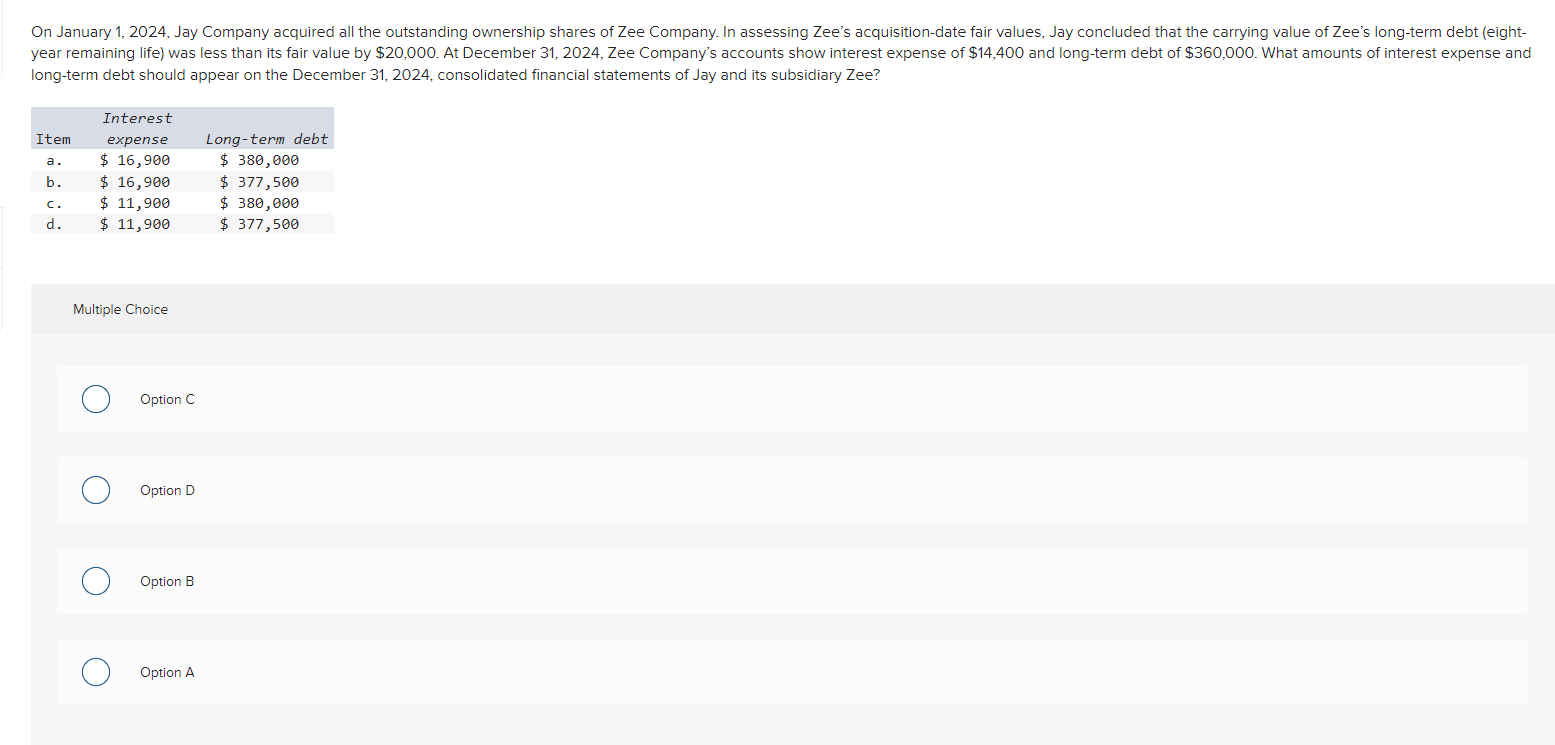

On January Jay Company acquired all the outstanding ownership shares of Zee Company. In assessing Zees acquisitiondate fair values, Jay concluded that the carrying value of Zees longterm debt eightyear remaining life was less than its fair value by $ At December Zee Companys accounts show interest expense of $ and longterm debt of $ What amounts of interest expense and longterm debt should appear on the December consolidated financial statements of Jay and its subsidiary Zee?

ItemInterest expenseLongterm debta.$ $ b$ $ c$ $ d$ $ On January Jay Company acquired all the outstanding ownership shares of Zee Company. In assessing Zee's acquisitiondate fair values, Jay concluded that the carrying value of Zee's longterm debt eightyear remaining life was less than its fair value by $ At December Zee Company's accounts show interest expense of $ and longterm debt of $ What amounts of interest expense and longterm debt should appear on the December consolidated financial statements of Jay and its subsidiary Zee?

Multiple Choice

Option C

Option D

Option B

Option A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock