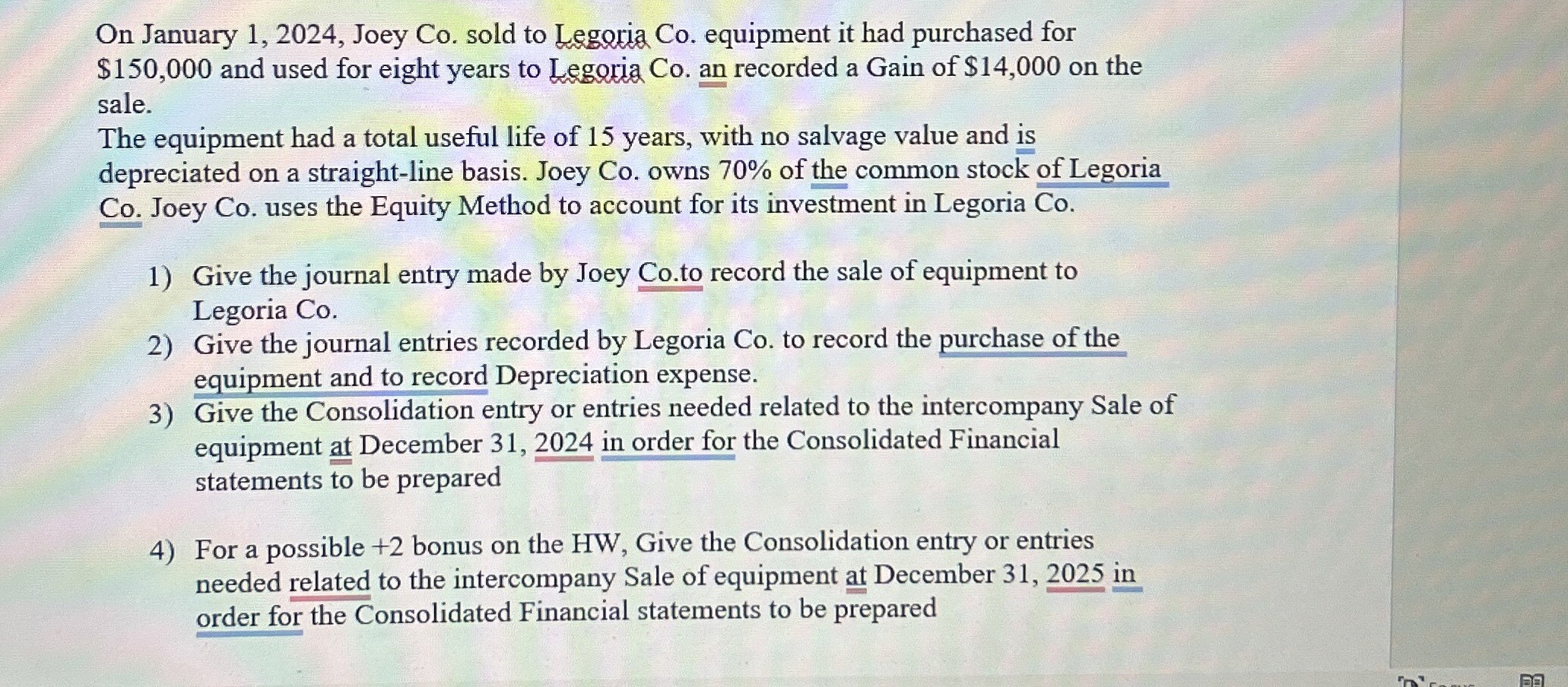

Question: On January 1 , 2 0 2 4 , Joey Co . sold to Legoria Co . equipment it had purchased for $ 1 5

On January Joey Co sold to Legoria Co equipment it had purchased for

$ and used for eight years to Legoria Co an recorded a Gain of $ on the

sale.

The equipment had a total useful life of years, with no salvage value and is

depreciated on a straightline basis. Joey Co owns of the common stock of Legoria

Co Joey Co uses the Equity Method to account for its investment in Legoria Co

Give the journal entry made by Joey

Coto record the sale of equipment to

Legoria Co

Give the journal entries recorded by Legoria Co to record the purchase of the

equipment and to record Depreciation expense.

Give the Consolidation entry or entries needed related to the intercompany Sale of

equipment at December in order for the Consolidated Financial

statements to be prepared

For a possible bonus on the HW Give the Consolidation entry or entries

needed related to the intercompany Sale of equipment at December in

order for the Consolidated Financial statements to be prepared

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock