Question: On January 1 , 2 0 2 4 , Pebble held merchandise acquired from Rock for ( $ 5 0 , 0 0

On January Pebble held merchandise acquired from Rock for $ During Rock sold merchandise to Pebble for $ of which Pebble holds $ on December Rock's gross profit on sales is On December Pebble still owes Rock $ for merchandise.

On December Pebble sold $ par value of year bonds which resulted in an effective interest rate of The bonds pay interest semiannually on June and December Both companies use the Effective Interest method to amortize any premium discount on the bonds.

On December Rock purchased $ par value of the parent's bonds, paying a price equal to par. The bonds are still held on December

On December Pebble sold equipment with a cost of $ and accumulated depreciation of $ to Rock for $ Rock will use the equipment beginning in

On July the subsidiary signed a mortgage note with its parent for $ Interest, at of the unpaid balance, and principal payments are due annually beginning July For convenience, the mortgage balances are not divided into current and longterm portions.

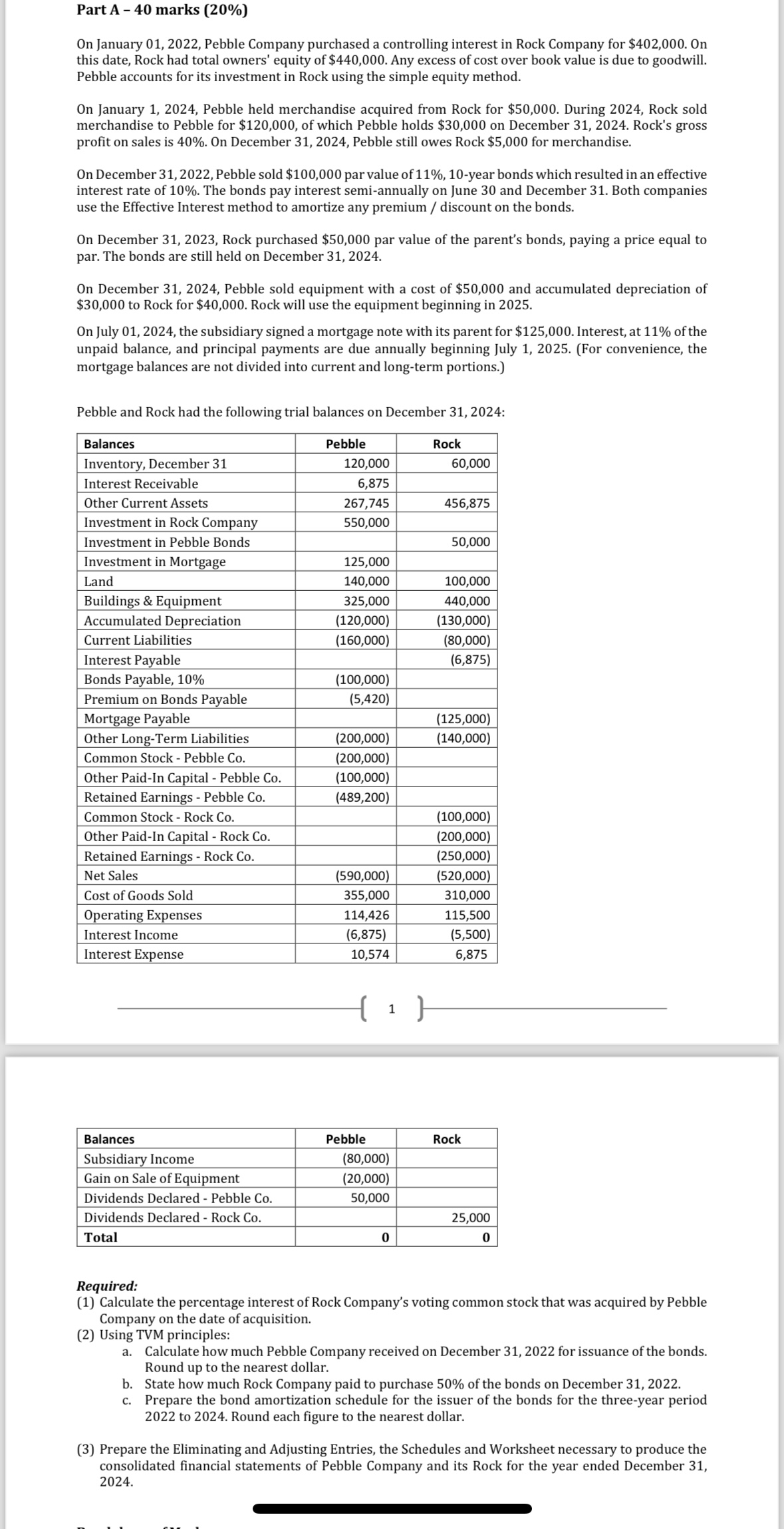

Pebble and Rock had the following trial balances on December :

Required:

Calculate the percentage interest of Rock Company's voting common stock that was acquired by Pebble Company on the date of acquisition.

Using TVM principles:

a Calculate how much Pebble Company received on December for issuance of the bonds. Round up to the nearest dollar.

b State how much Rock Company paid to purchase of the bonds on December

c Prepare the bond amortization schedule for the issuer of the bonds for the threeyear period to Round each figure to the nearest dollar.

Prepare the Eliminating and Adjusting Entries, the Schedules and Worksheet necessary to produce the consolidated financial statements of Pebble Company and its Rock for the year ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock