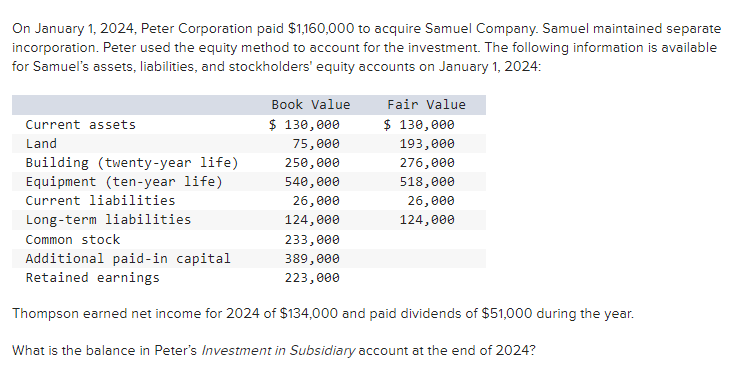

Question: On January 1 , 2 0 2 4 , Peter Corporation paid $ 1 , 1 6 0 , 0 0 0 to acquire Samuel

On January Peter Corporation paid $ to acquire Samuel Company. Samuel maintained separate

incorporation. Peter used the equity method to account for the investment. The following information is available

for Samuel's assets, liabilities, and stockholders' equity accounts on January :

Thompson earned net income for of $ and paid dividends of $ during the year.

What is the balance in Peter's Investment in Subsidiary account at the end of

Samuel earned net income for of $ and paid dividends of $ during the year. At the end of the consolidation entry to eliminate Peters accrual of Samuels earnings would include a credit to Investment in Samuel Company for

The total excess amortization of fairvalue allocations is calculated to be

Thompson earned net income for of $ and paid dividends of $ during the year. If Peter Corporation had net income of $ in exclusive of the investment, what is the amount of consolidated net income?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock