Question: On January 1 , 2 0 2 4 , Rick's Pawn Shop leased a truck from Corey Motors for a six - year period with

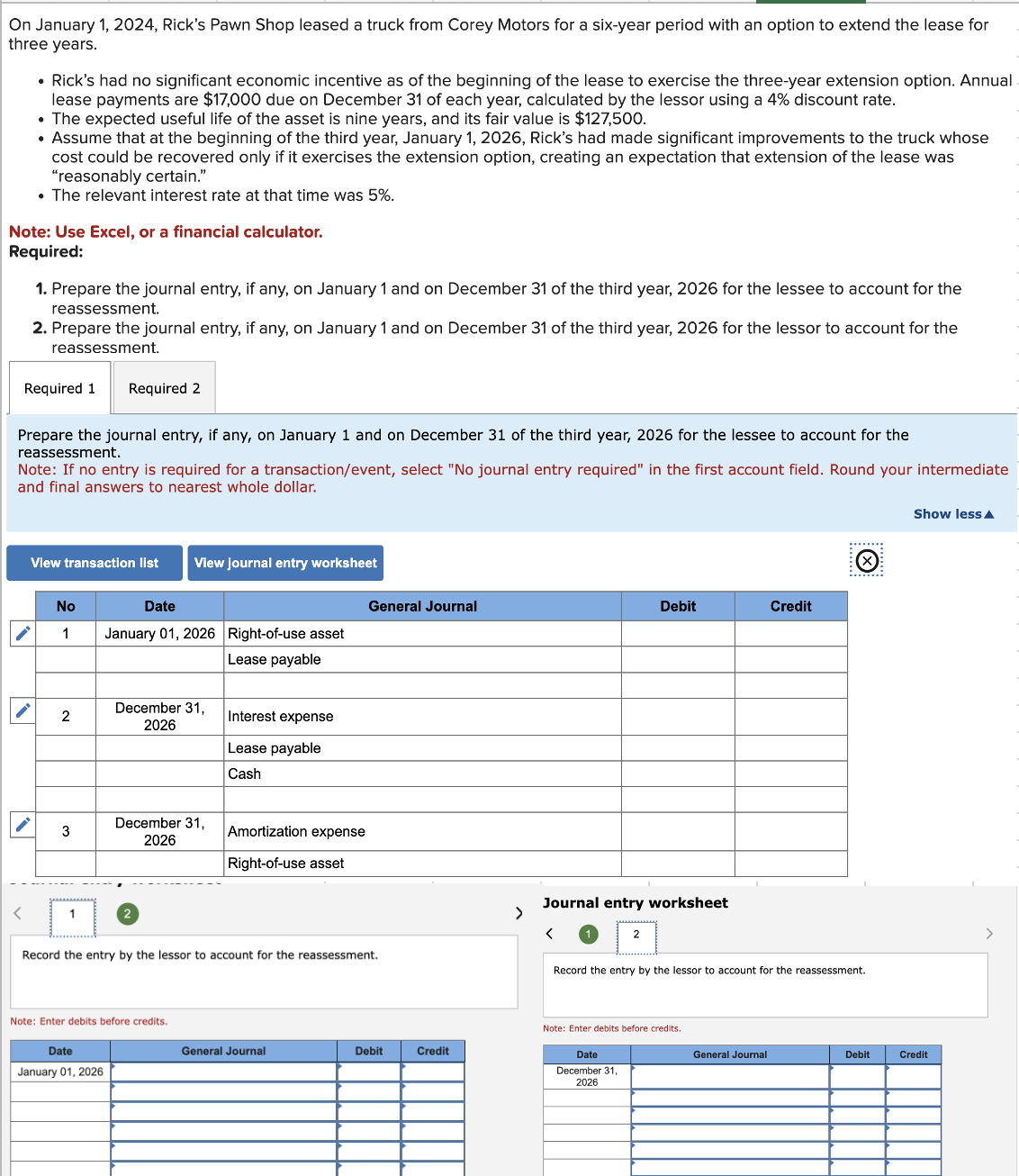

On January Rick's Pawn Shop leased a truck from Corey Motors for a sixyear period with an option to extend the lease for

three years.

Rick's had no significant economic incentive as of the beginning of the lease to exercise the threeyear extension option. Annual

lease payments are $ due on December of each year, calculated by the lessor using a discount rate.

The expected useful life of the asset is nine years, and its fair value is $

Assume that at the beginning of the third year, January Rick's had made significant improvements to the truck whose

cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was

"reasonably certain."

The relevant interest rate at that time was

Note: Use Excel, or a financial calculator.

Required:

Prepare the journal entry, if any, on January and on December of the third year, for the lessee to account for the

reassessment.

Prepare the journal entry, if any, on January and on December of the third year, for the lessor to account for the

reassessment.

Required

Prepare the journal entry, if any, on January and on December of the third year, for the lessee to account for the

reassessment.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Round your intermediate

and final answers to nearest whole dollar.

Record the entry by the lessor to account for the reassessment.

Record the entry by the lessor to account for the reassessment.

Note: Enter debits before credits.

Journal entry worksheet

Record the entry by the lessor to account for the reassessment.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock