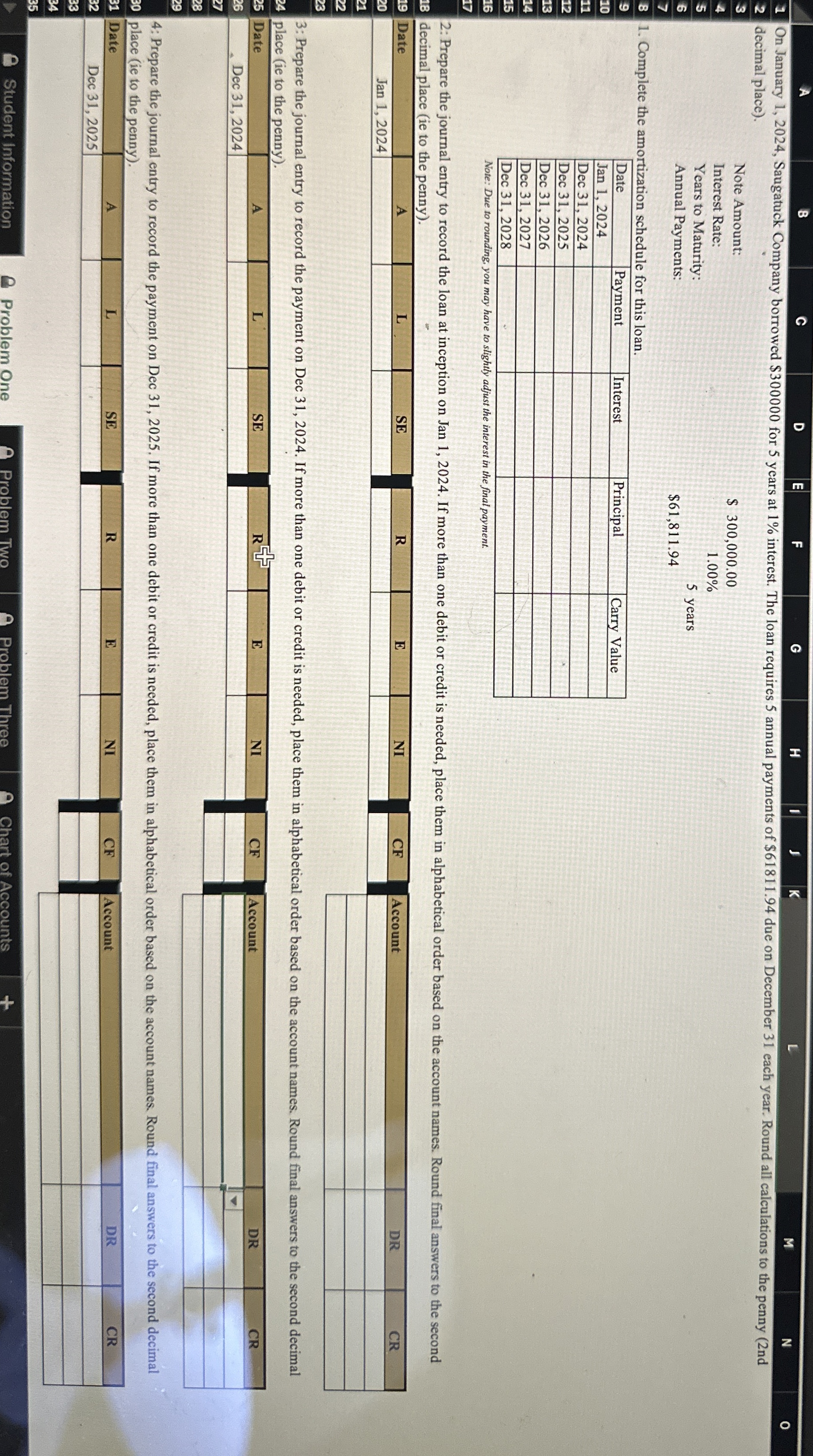

Question: On January 1 , 2 0 2 4 , Saugatuck Company borrowed $ 3 0 0 0 0 0 for 5 years at 1 %

On January Saugatuck Company borrowed $ for years at interest. The loan requires annual payments of $ due on December each year. Round all calculations to the penny nd decimal place

Note Amount:

Interest Rate:

Years to Maturity:

Annual Payments:

$

$

Complete the amortization schedule for this loan.

tableDatePayment,Interest,Principal,Carry ValueJan Dec Dec Dec Dec Dec

Note: Due to rounding, you may have to slightly adjust the interest in the final payment.

: Prepare the journal entry to record the loan at inception on Jan If more than one debit or credit is needed, place them in alphabetical order based on the account names. Round final answers to the second decimal place ie to the penny

tableDateALSEJan

table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock