Question: On January 1 , 2 0 2 4 , Sendipity Inc. acquired of of the outstanding common stock of Murphy Company for $ 5

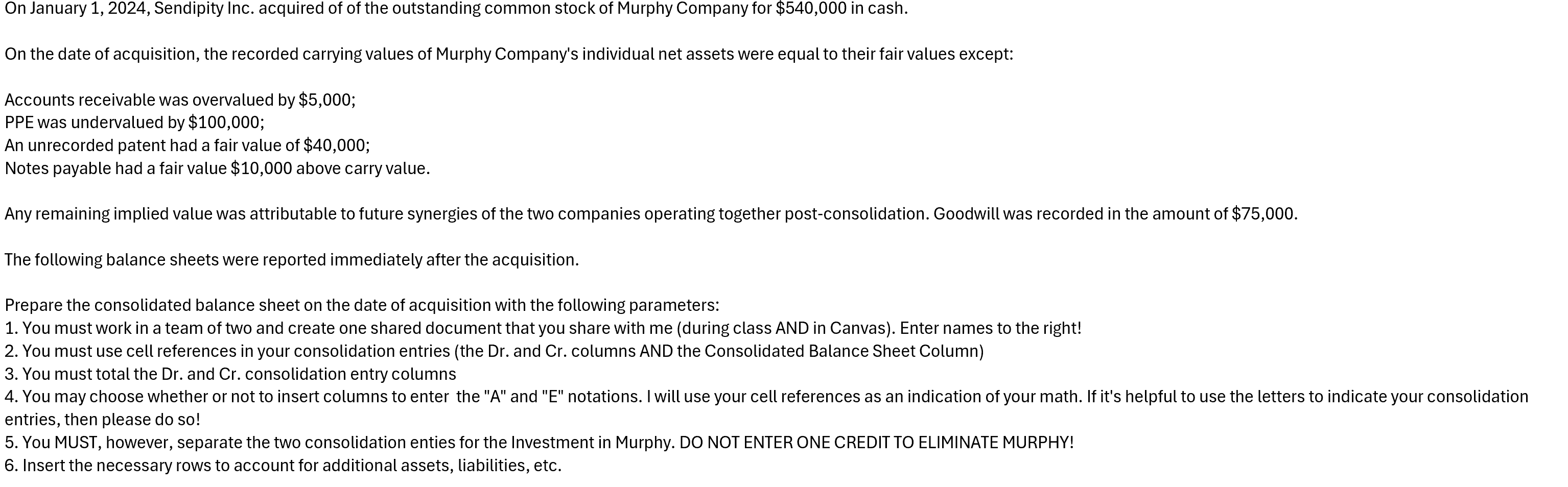

On January Sendipity Inc. acquired of of the outstanding common stock of Murphy Company for $ in cash.

On the date of acquisition, the recorded carrying values of Murphy Company's individual net assets were equal to their fair values except:

Accounts receivable was overvalued by $ ;

PPE was undervalued by $ ;

An unrecorded patent had a fair value of $ ;

Notes payable had a fair value $ above carry value.

Any remaining implied value was attributable to future synergies of the two companies operating together postconsolidation. Goodwill was recorded in the amount of $

The following balance sheets were reported immediately after the acquisition.

Prepare the consolidated balance sheet on the date of acquisition with the following parameters:

You must work in a team of two and create one shared document that you share with me during class AND in Canvas Enter names to the right!

You must use cell references in your consolidation entries the Dr and Cr columns AND the Consolidated Balance Sheet Column

You must total the Dr and Cr consolidation entry columns entries, then please do so

You MUST, however, separate the two consolidation enties for the Investment in Murphy. DO NOT ENTER ONE CREDIT TO ELIMINATE MURPHY!

Insert the necessary rows to account for additional assets, liabilities, etc. begintabularcccc

hline Serendipty Inc. & & Murphy Company &

hline Balance Sheet on January & & Balance Sheet on January &

hline Assets & & Assets &

hline Cash & & Cash &

hline Accounts receivable & & Accounts receivable &

hline Inventories & & Inventories &

hline PPE, net & & PPE, net &

hline Other assets & & Other assets &

hline Investment in Murphy & & &

hline & & &

hline & & Liabilities & Stockholders'Equity &

hline Liabilities & Stockholders' Equity & & Accounts payable &

hline Accounts payable & & Notes payable &

hline Notes payable & & Other liabiities &

hline Other liabiities & & Common stock &

hline Common stock & & Retained earnings &

hline Retained earnings & & &

hline & & &

hline & & &

hline & & &

hline & & &

hline & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock