Question: On January 1 , 2 0 2 4 , Sledge had common stock of $ 3 1 0 , 0 0 0 and retained earnings

On January Sledge had common stock of $ and retained earnings of $ During that year, Sledge reported

sales of $ cost of goods sold of $ and operating expenses of $

On January Percy, Incorporated, acquired percent of Sledge's outstanding voting stock. At that date, $ of the

acquisitiondate fair value was assigned to unrecorded contracts with a year life and $ to an undervalued building with a

year remaining life

In Sledge sold inventory costing $ to Percy for $ Of this merchandise, Percy continued to hold $ at year

end. During Sledge transferred inventory costing $ to Percy for $ Percy still held half of these items at yearend.

On January Percy sold equipment to Sledge for $ This asset originally cost $ but had a January book

value of $ At the time of transfer, the equipment's remaining life was estimated to be five years.

Percy has properly applied the equity method to the investment in Sledge.

Required:

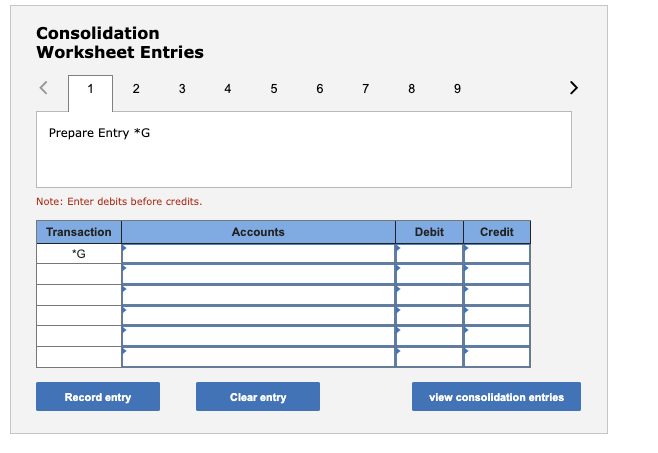

a Prepare worksheet entries to consolidate these two companies as of December

b Compute the net income attributable to the noncontrolling interest for

Complete this question by entering your answers in the tabs below.Consolidation

Worksheet Entries

Note: Enter debits before credits. Create all entries GTASAI,ETIGED

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock