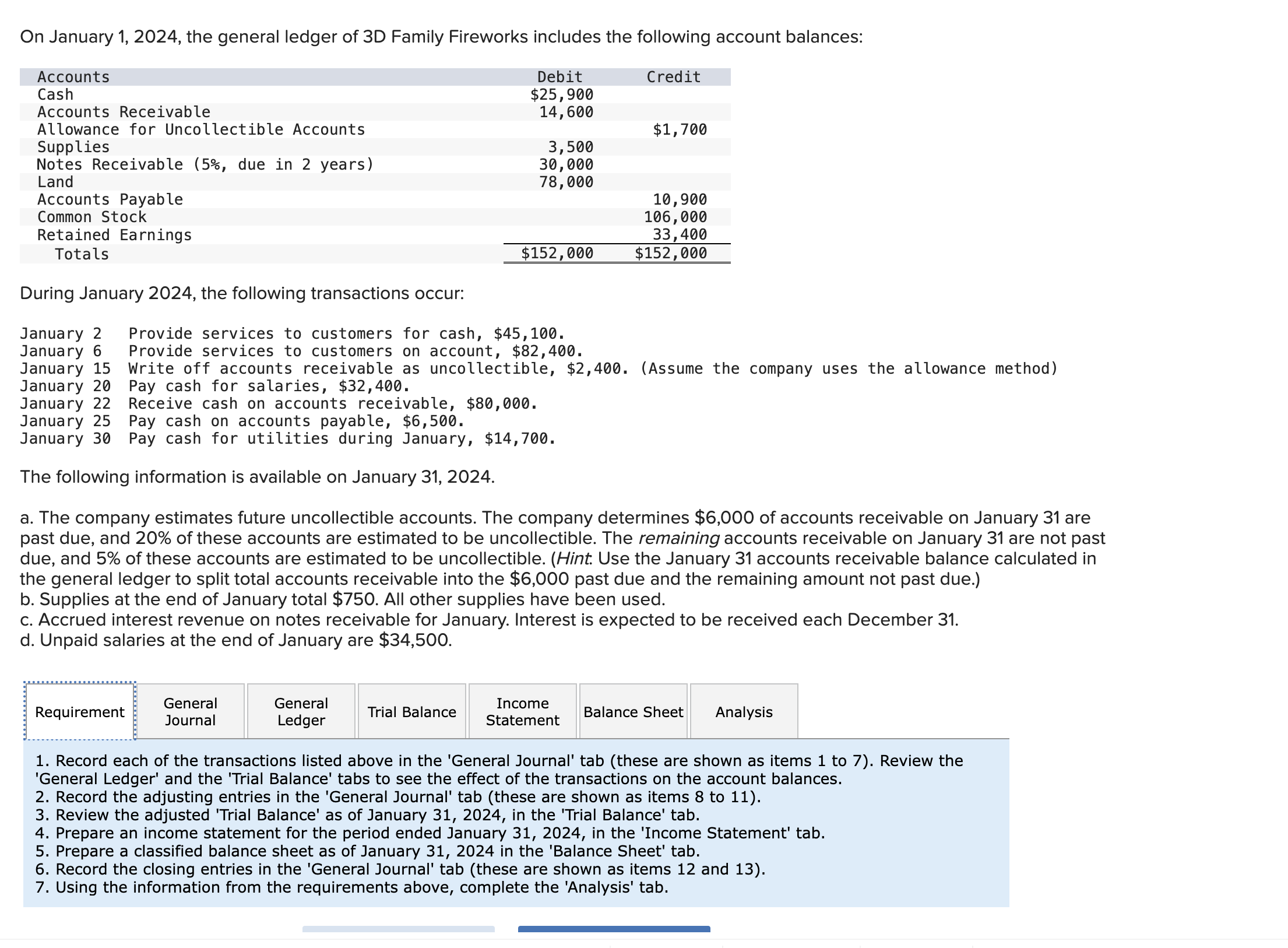

Question: On January 1 , 2 0 2 4 , the general ledger of 3 D Family Fireworks includes the following account balances: table [

On January the general ledger of D Family Fireworks includes the following account balances: tableNoDate,General Journal,Debit,CreditJanuary Cash January Accounts Receivable January Allowance for Uncollectible Accounts,January Salaries Payable times January Accounts Receivable times January Accounts Payable January Utilities Payable times January Allowance for Uncollectible Accounts times times January Supplies Expense,January Interest Receivable,January Salaries Expense,January Deferred Revenue times times January Salaries Expense times times Enter your Accounts Receivable turnover value rounded to decimal place and Ratio of Allowance for Uncollectible Accounts as a

percentage rounded to decimal place.

Analyze how well D Family Fireworks manages its receivables

a Calculate the receivables turnover ratio for the month of January. Hint: For the numerator, use total services provided to customers

on account. If the industry average of the receivables turnover ratios for the month of January is times, is the company collecting

cash from customers more or less efficiently than other companies in the same industry? Requirement

General

General

Income

Journal

Trial Balance

Balance Sheet

Analysis

Choose the appropriate accounts to complete the company's balance sheet. Make sure to select 'adjusted' from the dropdown, whic then populate the balances in those accounts from the adjusted trial balance.

Postclosing

tableD Family FireworksBalance SheetJanuary AssetsLiabilitiesCurrent Assets:,,,Current Liabilities:,,$Total Current Liabilities,,Total Current Assets,,Total Liabilities,,Longterm assets:,,,Stockholders' Equity,,Total Stockholders' Equity,,Total Assets,$Total Liabilities & Stockholders' Equity,$Requirement

General

General

Journal

Trial Balance

Income

Balance Sheet

Choose the appropriate accounts to complete the company's income statement. Select 'adjusted' from the dropdown, which will then populate the balances in those accounts from the adjusted trial balance.

Postclosing

tableD Family FireworksIncome Statement,Revenue:$Total Revenue,,Expenses:Total Expenses,,

During January the following transactions occur:

January Provide services to customers for cash, $

January Provide services to customers on account, $

January Write off accounts receivable as uncollectible, $Assume the company uses the allowance method

January Pay cash for salaries, $

January Receive cash on accounts receivable, $

January Pay cash on accounts payable, $

January Pay cash for utilities during January, $

The following information is available on January

a The company estimates future uncollectible accounts. The company determines $ of accounts receivable on January are

past due, and of these accounts are estimated to be uncollectible. The remaining accounts receivable on January are not past

due, and of these accounts are estimated to be uncollectible. Hint Use the January accounts receivable balance calculated in

the general ledger to split total accounts receivable into the $ past due and the remaining amount not past due.

b Supplies at the end of January total $ All other supplies have been used.

c Accrued interest revenue on notes receivable for January. Interest is expected to be received each December

d Unpaid salaries at the end of January are $

Record each of the transactions listed above in the 'General Journal' tab these are shown as items to Review the

'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances.

Record the adjusting entries in the 'General Journal' tab these are shown as items to

Review the adjusted 'Trial Balance' as of January in the 'Trial Balance' tab.

Prepare an income statement for the period ended January in the 'Income Statement' tab.

Prepare a classified balance sheet as of January in the 'Balance Sheet' tab.

Record the closing entries in the 'General Journal' tab these are shown as items and

Using the information from the requirements above, complete the 'Analysis' tab.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock