Question: On January 1 , 2 0 2 4 , the general ledger of Parts Unlimited includes the following account balances: Accounts TitleDebitCreditCash$ 1 7 5

On January the general ledger of Parts Unlimited includes the following account balances:

Accounts TitleDebitCreditCash$ Accounts ReceivableInventoryLandEquipmentAccumulated depreciation$ Accounts PayableCommon stockRetained EarningsTotals$ $

From January to December the following summary transactions occurred:

Purchased inventory on account, $

Sold inventory on account, $ The inventory cost $

Received cash from customers on account, $

Paid cash on account, $

Paid cash for salaries, $ and for utilities, $

In addition, Parts Unlimited had the following transactions during the year:

April Purchased equipment for $ using a note payable, due in months plus interest. The company also paid cash of $ for freight and $ for installation and testing of the equipment. The equipment has an estimated residual value of $ and a year service life.June Purchased a patent for $ from a thirdparty marketing company related to the packaging of the companys products. The patent has a year useful life, after which it is expected to have no value.October Sold equipment for $ The equipment cost $ and had accumulated depreciation of $ at the beginning of the year. Additional depreciation for up to the point of the sale is $Hint: Total accumulated depreciation equals the amount at the beginning of the year plus the amount recorded for the current year.November Several older pieces of equipment were improved by replacing major components at a cost of $ These improvements are expected to enhance the equipments operating capabilities. Record this transaction using Alternative capitalization of new cost.

Yearend adjusting entries:

Depreciation on the equipment purchased on April calculated using the straightline method.

Depreciation on the remaining equipment, $

Amortization of the patent purchased on June using the straightline method.

Accrued interest payable on the note payable.

Equipment with an original cost of $ had the following related information at the end of the year: accumulated depreciation of $ expected cash flows of $ and a fair value of $

Accrued income taxes at the end of the year are $

Google

Unit AS: Exercises and Proble

Chat Learn with Chegg Cheg

Question Unit AS: Exercise

income statement example Gc

Google Chrome isn't your default browser

Set as default

Unit AS: Exercises and Problems Connect i

Saved

Help

Save & Exit

Submit

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

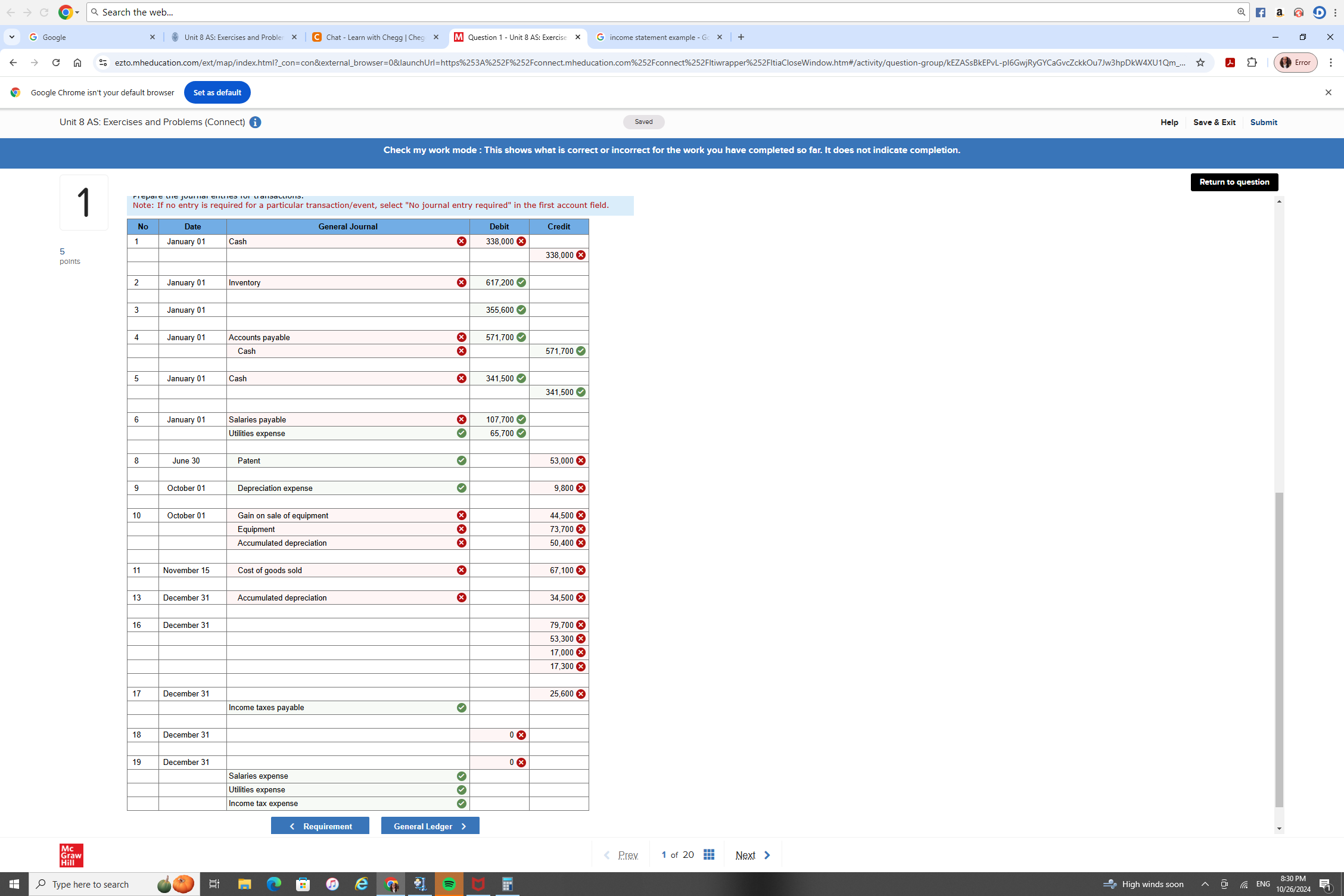

Note: If no entry is required for a particular transactionevent select No journal entry required" in the first account field.

No Date General Journal Debit Credit January Cash January Inventory January January Accounts payable Cash January Cash o January Salaries payable Utilities expense June Patent xx October Depreciation expense xx October Gain on sale of equipment xx Equipment Accumulated depreciation xx November Cost of goods sold xx December Accumulated depreciation xx December xx xx December xx Income taxes payable December December Salaries expense Utilities expense Income tax expense O

Requirement

General Ledger

of

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock