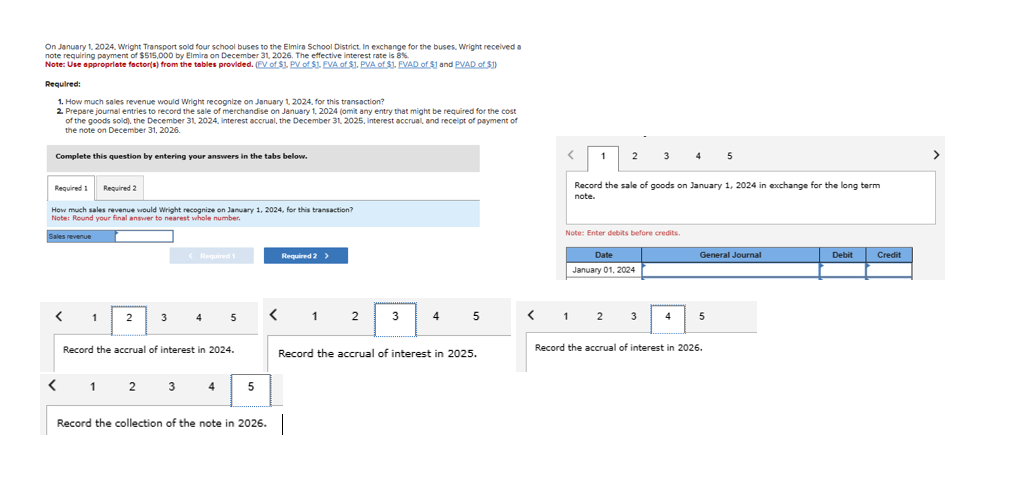

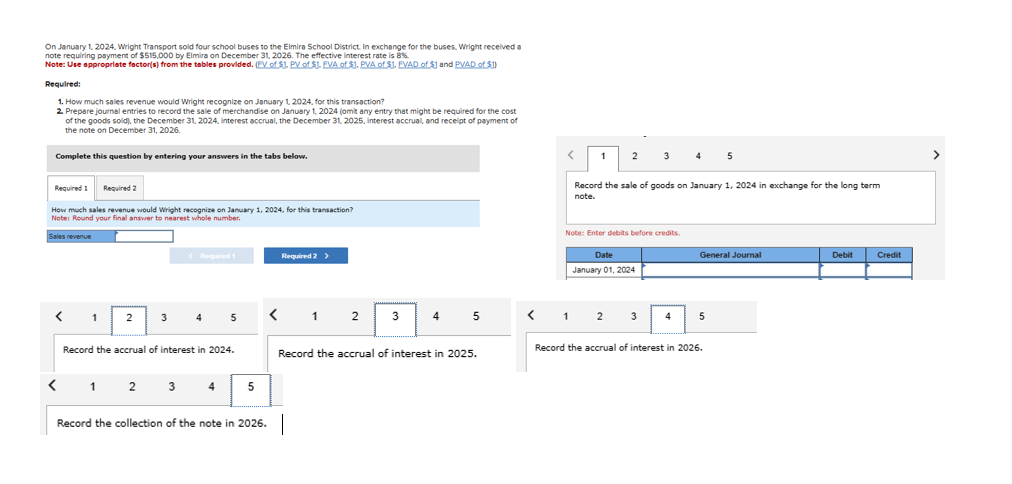

Question: On January 1 . 2 0 2 4 . Wright Transport sold four school buses to the Elmira School District. In exchange for the buses.

On January Wright Transport sold four school buses to the Elmira School District. In exchange for the buses. Wright received a

note requiring payment of $ by Elmira on December The effective interest rate is $

Note: Use oppropriate foctors from the tables provided. PV of S PV of S PVA of S PVA of S PVAD of $ and PVAD of S

Required:

How much sales revenue would Wright recognize on January for this transaction?

Prepare joumal entries to record the sale of merchandise on January omit any entry that might be required for the cost

of the goods soldl, the December interest accrual, the December interest accrual, and recelpt of payment of

the note on December

Complete this question by entering your answers in the tabs below.

How much sales revenue would Wright recognize on January for this transaction?

Note: Reund your final answer to nearest whole number.

Sales revenue

Sales nevenue

Record the sale of goods on January in exchange for the long term

note.

Note: Enter debits before credits.

Record the accrual of interest in

Record the accrual of interest in

Record the accrual of interest in

Record the collection of the note in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock