Question: On January 1 , 2 0 2 5 , Epsilon, exchanged $ 2 1 3 , 6 0 0 for 3 0 % of Zeta.

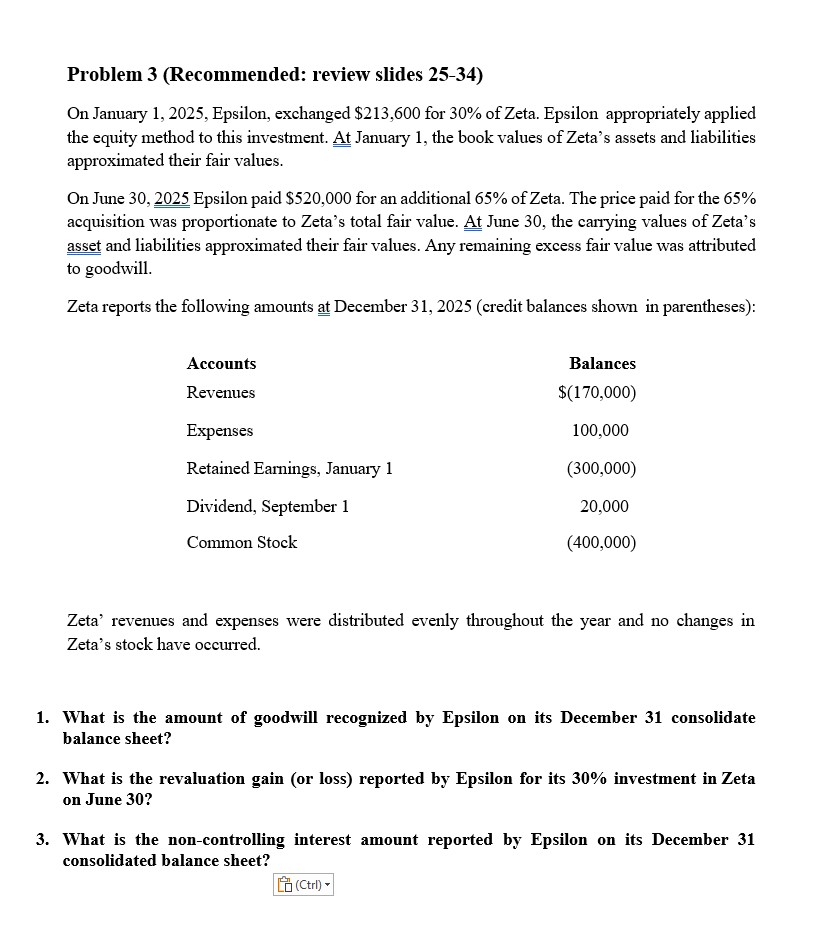

On January Epsilon, exchanged $ for of Zeta. Epsilon appropriately applied the equity method to this investment. At January the book values of Zetas assets and liabilities approximated their fair values.

On June Epsilon paid $ for an additional of Zeta. The price paid for the acquisition was proportionate to Zetas total fair value. At June the carrying values of Zetas asset and liabilities approximated their fair values. Any remaining excess fair value was attributed to goodwill.

Zeta reports the following amounts at December credit balances shown in parentheses:

Accounts Balances

Revenues $

Expenses

Retained Earnings, January

Dividend, September

Common Stock

Zeta revenues and expenses were distributed evenly throughout the year and no changes in Zetas stock have occurred.

What is the amount of goodwill recognized by Epsilon on its December consolidate balance sheet?

What is the revaluation gain or loss reported by Epsilon for its investment in Zeta on June

What is the noncontrolling interest amount reported by Epsilon on its December consolidated balance sheet?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock