Question: On January 1 , 2 0 2 5 , Kingbird Corporation started the year with a balance in Accounts Receivable of $ 1 4 4

On January Kingbird Corporation started the year with a balance in Accounts Receivable of $ and a credit balance in Allowance for Doubtful Accounts of $ During the company had total sales of $; of these sales were credit sales. Collections not including the cash sales during the period were $ Kingbird wrote off as uncollectible accounts receivable of $ In addition, an account of $ that was previously written off an uncollectible was recovered during the year. Uncollectible accounts are estimated to be of the endofyear Accounts Receivable balance. Omit cost of goods sold entries.

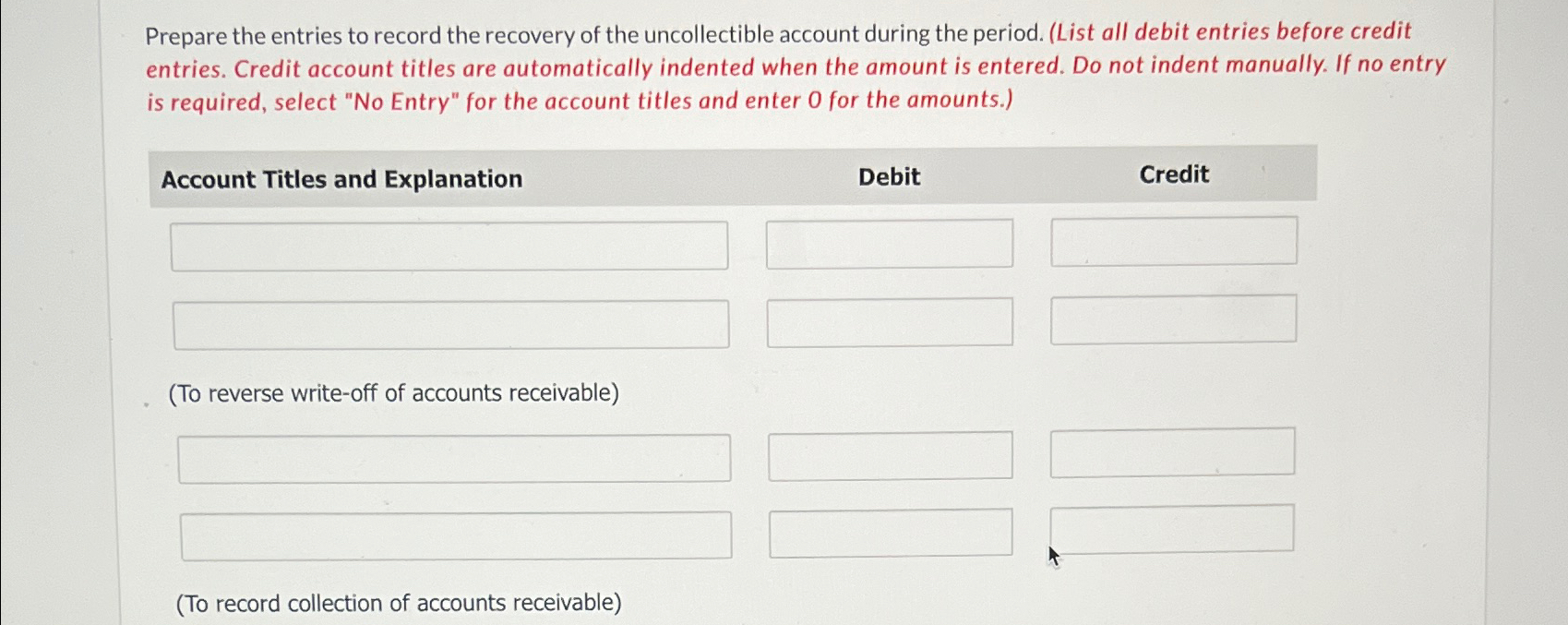

Prepare the entries to record the recovery of the uncollectible account during the period. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts.

Account Titles and Explanation

Debit

Credit

To reverse writeoff of accounts receivable

To record collection of accounts receivable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock