Question: On January 1 , 2 0 2 5 , Kingbird, Inc. signed a fixed - price contract to have Builder Associates construct a major plant

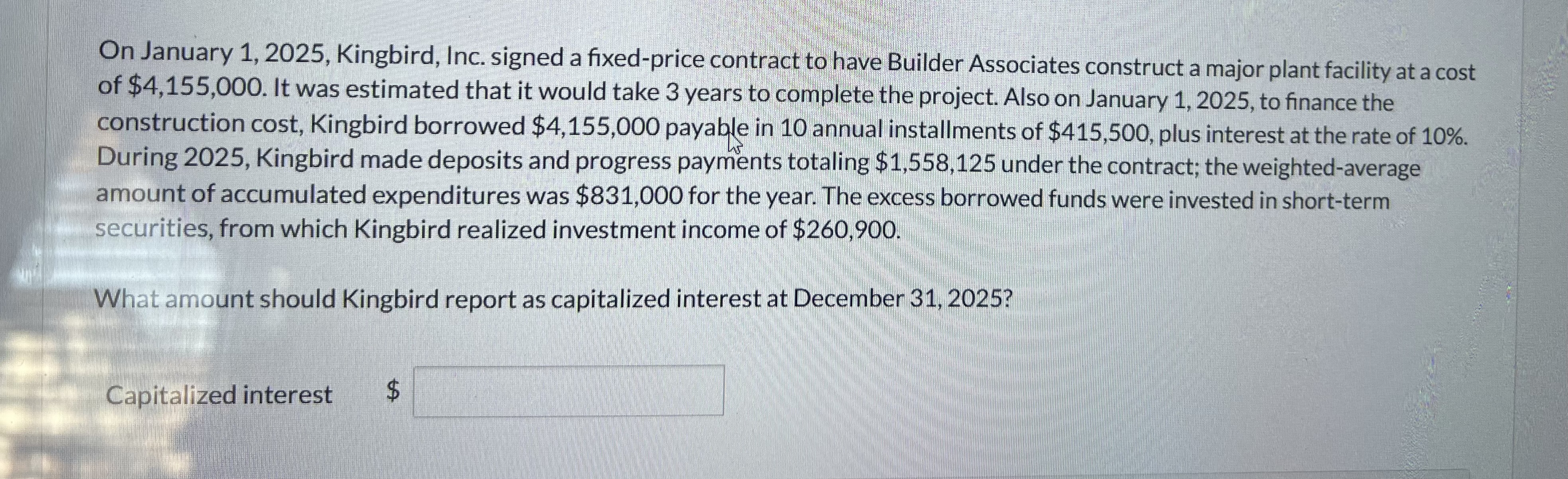

On January Kingbird, Inc. signed a fixedprice contract to have Builder Associates construct a major plant facility at a cost of $ It was estimated that it would take years to complete the project. Also on January to finance the construction cost, Kingbird borrowed $ payable in annual installments of $ plus interest at the rate of During Kingbird made deposits and progress payments totaling $ under the contract; the weightedaverage amount of accumulated expenditures was $ for the year. The excess borrowed funds were invested in shortterm securities from which Kingbird realized investment income of $

What amount should Kingbird report as capitalized interest at December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock