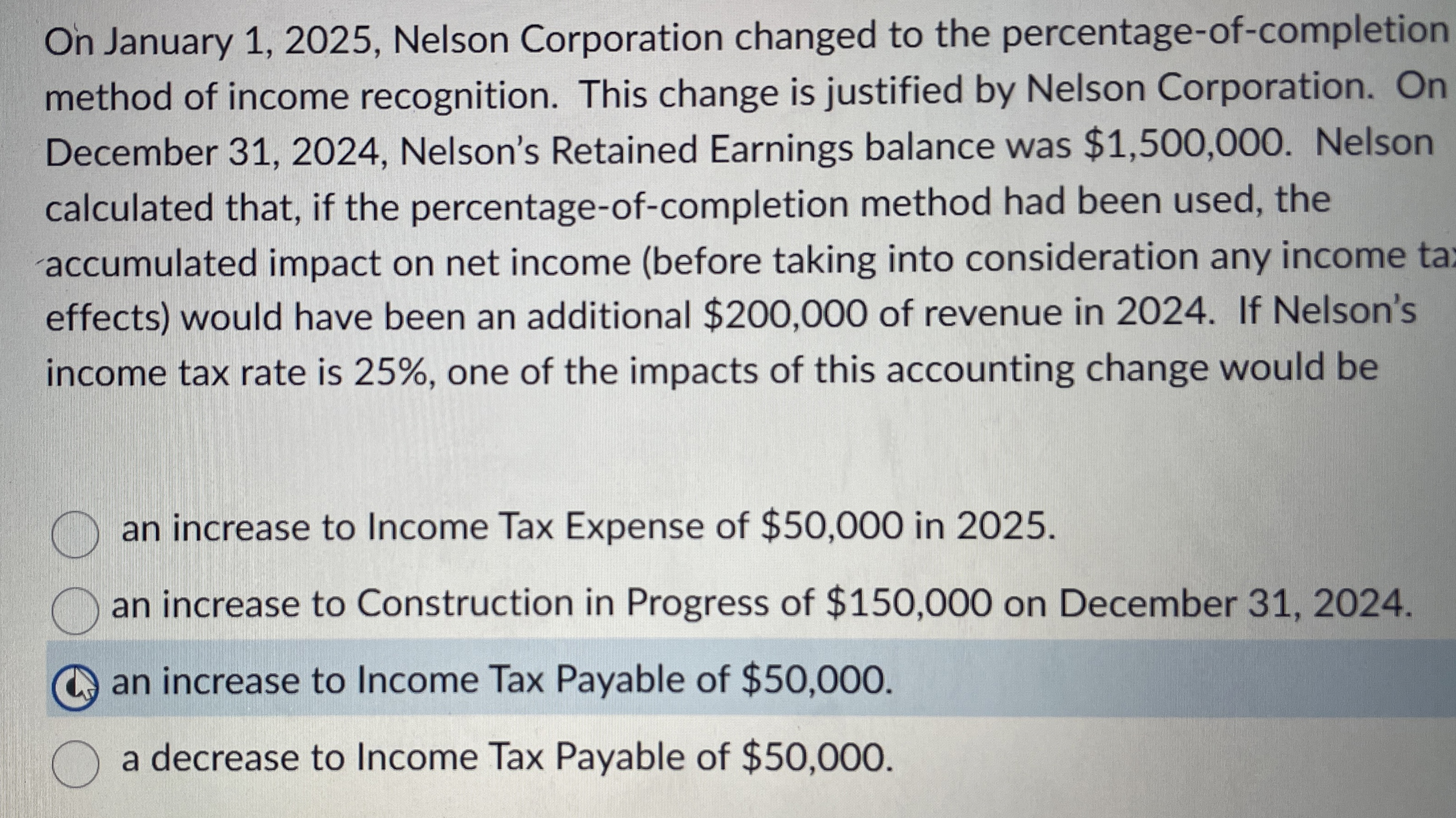

Question: On January 1 , 2 0 2 5 , Nelson Corporation changed to the percentage - of - completion method of income recognition. This change

On January Nelson Corporation changed to the percentageofcompletion method of income recognition. This change is justified by Nelson Corporation. On December Nelson's Retained Earnings balance was $ Nelson calculated that, if the percentageofcompletion method had been used, the accumulated impact on net income before taking into consideration any income ta: effects would have been an additional $ of revenue in If Nelson's income tax rate is one of the impacts of this accounting change would be

an increase to Income Tax Expense of $ in

an increase to Construction in Progress of $ on December

an increase to Income Tax Payable of $

a decrease to Income Tax Payable of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock