Question: On January 1 , 2 0 X 0 , Pepper Corporation issued 7 , 0 0 0 of its $ 1 0 par value shares

On January X Pepper Corporation issued of its $ par value shares to acquire percent of the shares of Salt

Manufacturing. Salt Manufacturing's balance sheet immediately before the acquisition contained the following items:

On the date of the stock acquisition, Pepper's shares were selling at $ and Salt Manufacturing's buildings and equipment had a

remaining economic life of years. The amount of the differential assigned to goodwill is not impaired.

In the two years following the stock acquisition, Salt Manufacturing reported net income of $ and $ and paid dividends

of $ and $ respectively. Pepper used the equity method in accounting for its ownership of Salt Manufacturing.

b Prepare the journal entries recorded by Pepper during X related to its investment in Salt Manufacturing.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the dividends received from Salt Manufacturing.

Note: Enter debits before credits.

b Prepare the journal entries recorded by Pepper during X related to its investment in Salt Manufacturing.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the equitymethod income for period.

Note: Enter debits before credits.

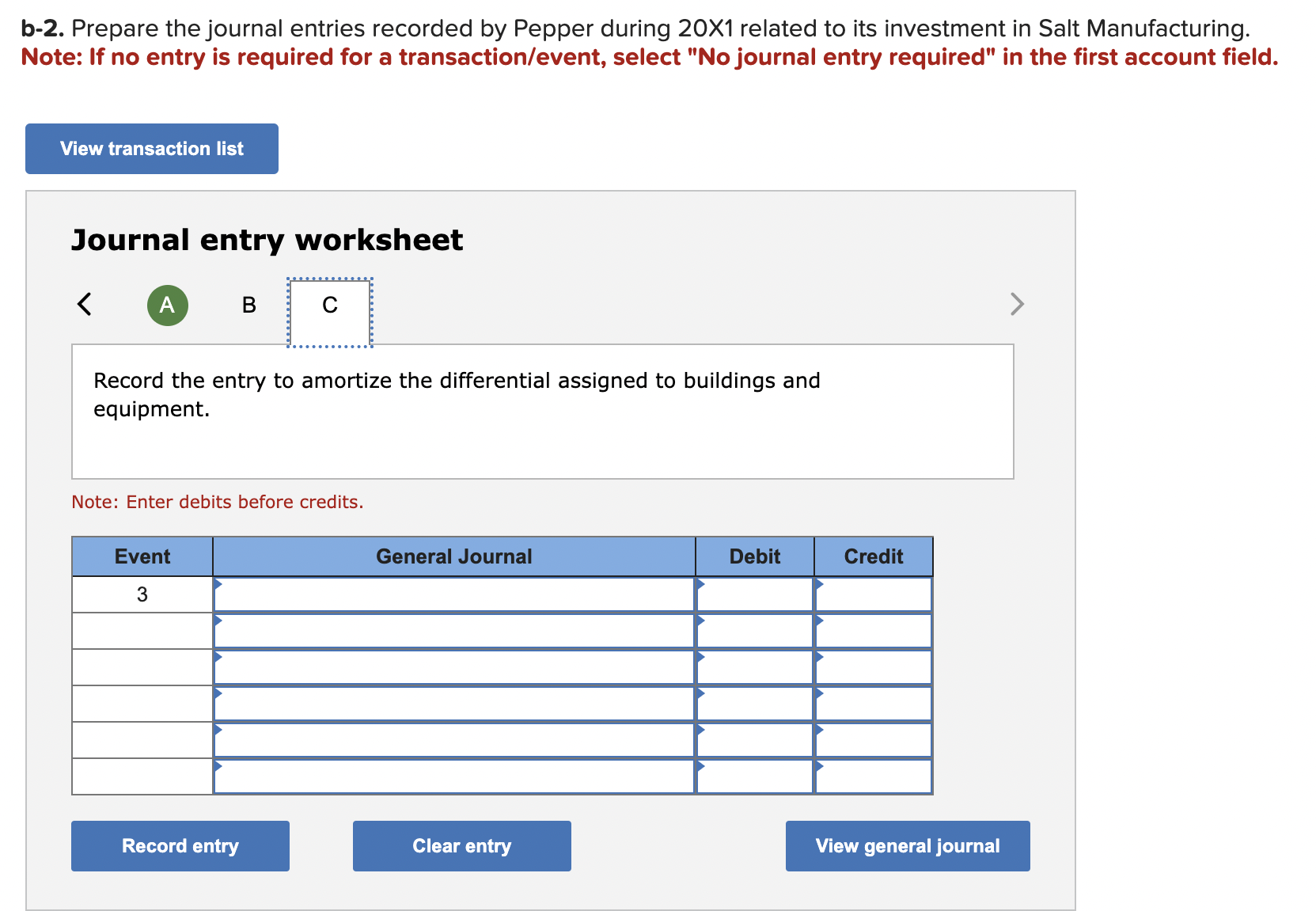

b Prepare the journal entries recorded by Pepper during X related to its investment in Salt Manufacturing.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the entry to amortize the differential assigned to buildings and

equipment.

Note: Enter debits before credits.

b Prepare the journal entries recorded by Pepper during X related to its investment in Salt Manufacturing.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

A

C

Record the equitymethod income for period.

Note: Enter debits before credits.

b Prepare the journal entries recorded by Pepper during X related to its investment in Salt Manufacturing.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

B

C

Record the entry to amortize the differential assigned to buildings and

equipment.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock