Question: On January 1 , 2 0 X 4 , Acme Corporation acquired 1 0 0 % of the outstanding common stock of Coyote, a

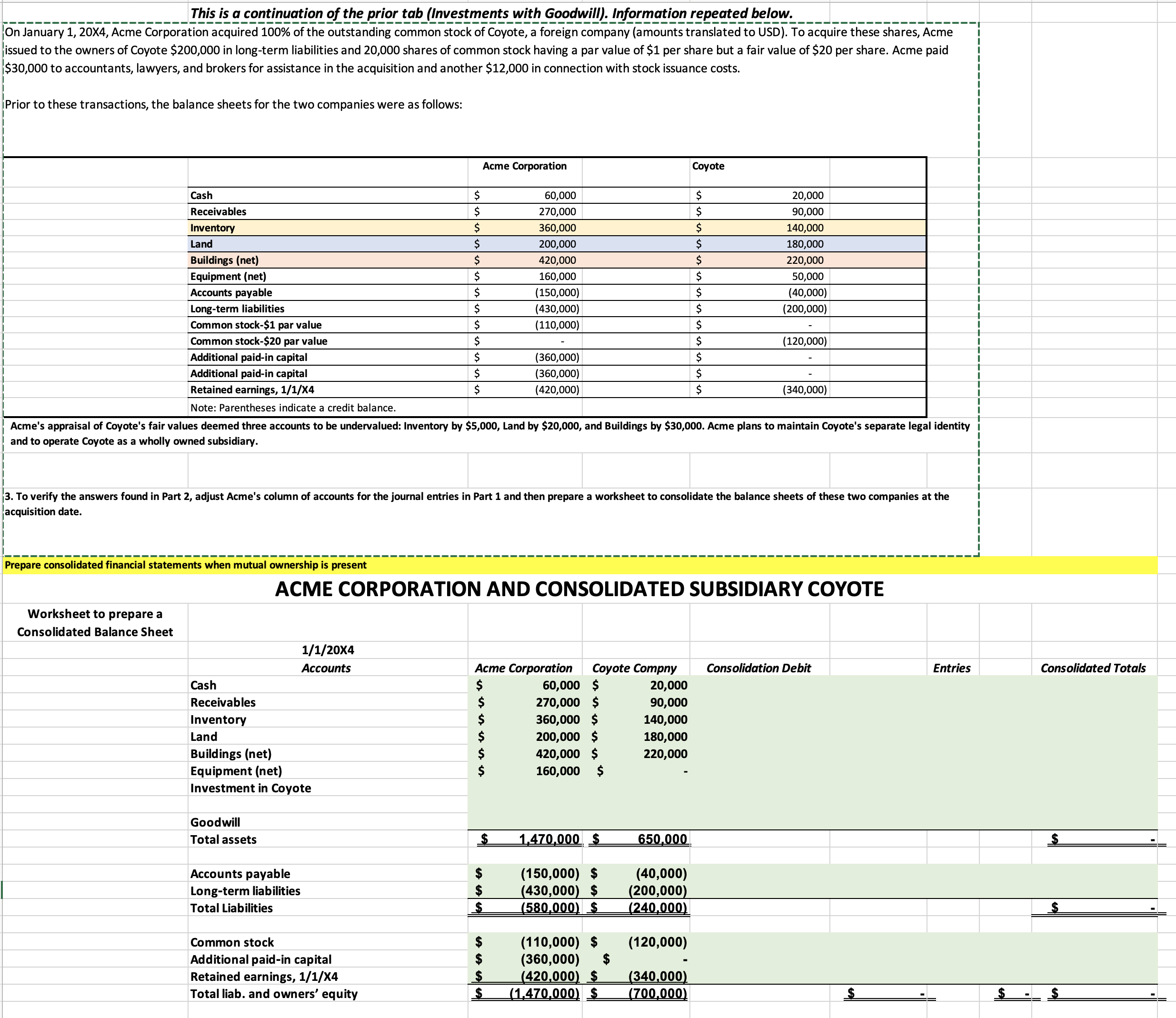

On January X Acme Corporation acquired of the outstanding common stock of Coyote, a foreign company amounts translated to USD To acquire these shares, Acme issued to the owners of Coyote $ in longterm liabilities and shares of common stock having a par value of $ per share but a fair value of $ per share. Acme paid $ to accountants, lawyers, and brokers for assistance in the acquisition and another $ in connection with stock issuance costs. This is a continuation of the prior tab Investments with Goodwill Information repeated below.

On January X Acme Corporation acquired of the outstanding common stock of Coyote, a foreign company amounts translated to USD To acquire these shares, Acme

issued to the owners of Coyote $ in longterm liabilities and shares of common stock having a par value of $ per share but a fair value of $ per share. Acme paid

$ to accountants, lawyers, and brokers for assistance in the acquisition and another $ in connection with stock issuance costs.

Prior to these transactions, the balance sheets for the two companies were as follows:

Acme's appraisal of Coyote's fair values deemed three accounts to be undervalued: Inventory by $ Land by $ and Buildings by $ Acme plans to maintain Coyote's separate legal identity

and to operate Coyote as a wholly owned subsidiary.

To verify the answers found in Part adjust Acme's column of accounts for the journal entries in Part and then prepare a worksheet to consolidate the balance sheets of these two companies at the

acquisition date.

Prepare consolidated financial statements when mutual ownership is present

ACME CORPORATION AND CONSOLIDATED SUBSIDIARY COYOTE

Worksheet to prepare a

Consolidated Balance Sheet

Prior to these transactions, the balance sheets for the two companies were as follows:"

Acme Corporation Coyote

Cash $ $

Receivables $ $

Inventory $ $

Land $ $

Buildings net $ $

Equipment net $ $

Accounts payable $ $

Longterm liabilities $ $

Common stock$ par value $ $

Common stock$ par value $ $

Additional paidin capital $ $

Additional paidin capital $ $

Retained earnings, X $ $

Note: Parentheses indicate a credit balance.

Acme's appraisal of Coyote's fair values deemed three accounts to be undervalued: Inventory by $ Land by $ and Buildings by $ Acme plans to maintain Coyote's separate legal identity and to operate Coyote as a wholly owned subsidiary.

To verify the answers found in Part adjust Acme's column of accounts for the journal entries in Part and then prepare a worksheet to consolidate the balance sheets of these two companies at the acquisition date.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock