Question: On January1, 20X7, Mannix Corporation purchased 80% of the outstanding common stock of Raun Company. No excess of cost or book value resulted from

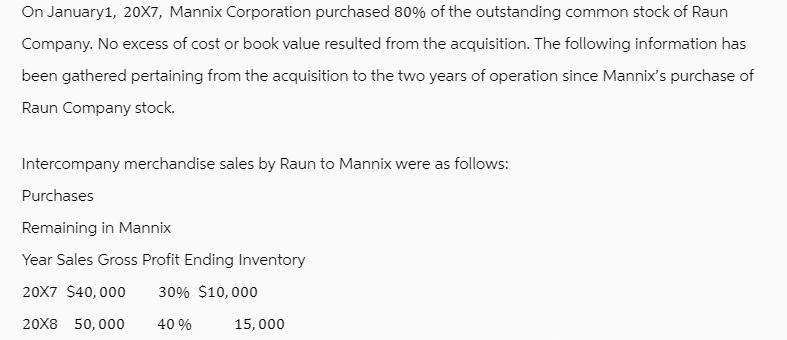

On January1, 20X7, Mannix Corporation purchased 80% of the outstanding common stock of Raun Company. No excess of cost or book value resulted from the acquisition. The following information has been gathered pertaining from the acquisition to the two years of operation since Mannix's purchase of Raun Company stock. Intercompany merchandise sales by Raun to Mannix were as follows: Purchases Remaining in Mannix Year Sales Gross Profit Ending Inventory 30% $10,000 20X7 $40,000 20X8 50,000 40% 15,000 Mannix wrote down the merchandise from Raun and remaining in its ending inventory to $13,000 on December 31,20X8 On December 31, 20X8, Mannix owed $10,000 pertaining to intercompany sales. Instructions: Complete the partial worksheet for 20X8 Prepare your elimination entries and post to them to worksheetMannix Corporation and Subsidiary Raun Company Partial Worksheet For the Year Ended December 31, 20X8Mannix Corporation and Subsidiary Raun Company Partial Worksheet For the Year Ended December 31, 20X8Mannix Corporation and Subsidiary Raun Company Partial Worksheet For the Year Ended December 31, 20X8 Trial Balance Eliminations and Adjustments Consolidated Income Statement Mannix

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

To complete the partial worksheet for 20X8 and prepare the elimination entries for Mannix Corporatio... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663e65ffa4c05_956946.pdf

180 KBs PDF File

663e65ffa4c05_956946.docx

120 KBs Word File