Question: On January 1 , 2 0 X 8 , Plane Company acquired 8 0 percent of Scalar Company's ownership for $ 1 2 0 ,

On January X Plane Company acquired percent of Scalar Company's ownership for $ cash. At that date, the fair value of the noncontrolling interest was $ The book value of Scalar's net assets at acquisition was $ The book values and fair values of Scalar's assets and liabilities were equal, except for buildings and equipment, which were worth $ more than book value. Buildings and equipment are depreciated on a year basis. Although goodwill is not amortized, the management of Plane concluded at December X that goodwill from its acquisition of Scalar shares had been impaired and the correct carrying amount was $ Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. No additional impairment occurred in X

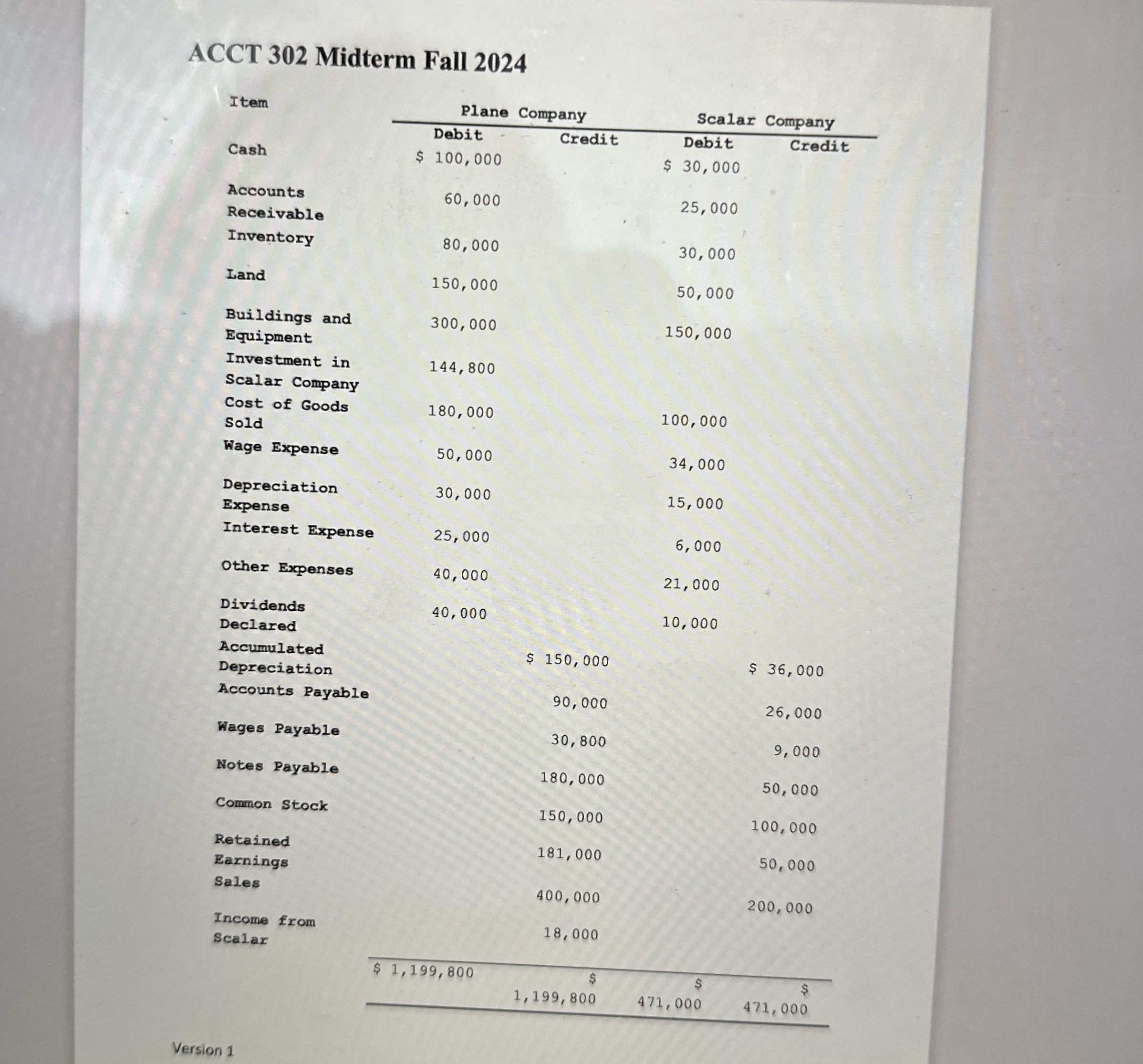

Trial balance data for Plane and Scalar on December X are as follows:

ACCT Midterm Fall

Version

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock