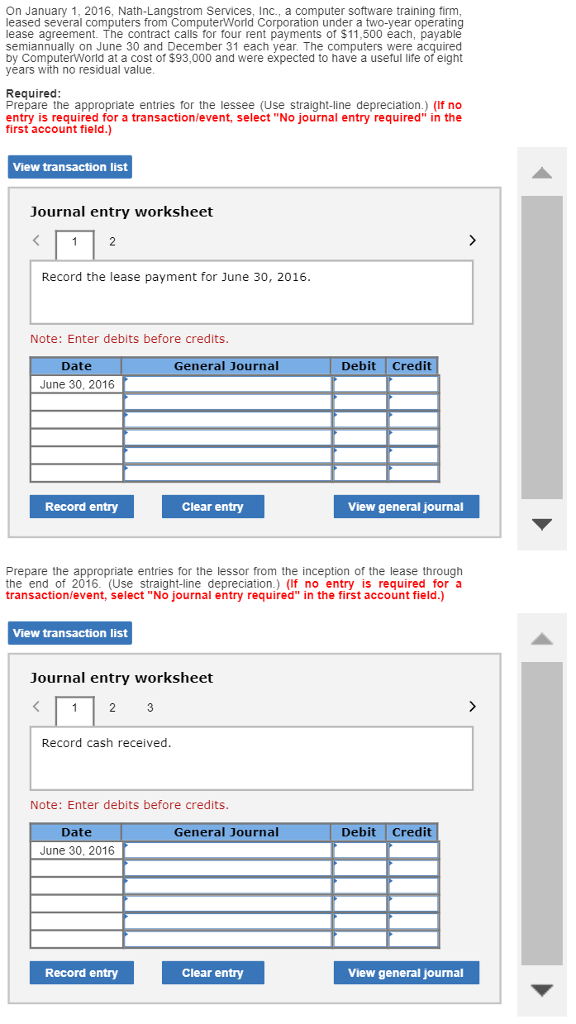

Question: On January 1, 2016. Nath-Langstrom Services, Inc., a computer software training firm, leased several computers from ComputerWorld Corporation under a two-year operating lease agreement. The

On January 1, 2016. Nath-Langstrom Services, Inc., a computer software training firm, leased several computers from ComputerWorld Corporation under a two-year operating lease agreement. The contract calls for four rent payments of $11, 500 each, payable semiannually on June 30 and December 31 each year. The computers were acquired by ComputerWorld at a cost of $93,000 and were expected to have a useful life of eight years with no residual value. Prepare the appropriate entries for the lessee (Use straight-line depreciation.) (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record the lease payment for June 30, 2016. Prepare the appropriate entries for the lessor from the inception of the lease through the end of 2016. (Use straight-line depreciation.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts