Question: On January 2 , 2 0 2 4 , Daeva Furniture purchased display shelving for $ 8 , 2 0 0 cash, expecting the shelving

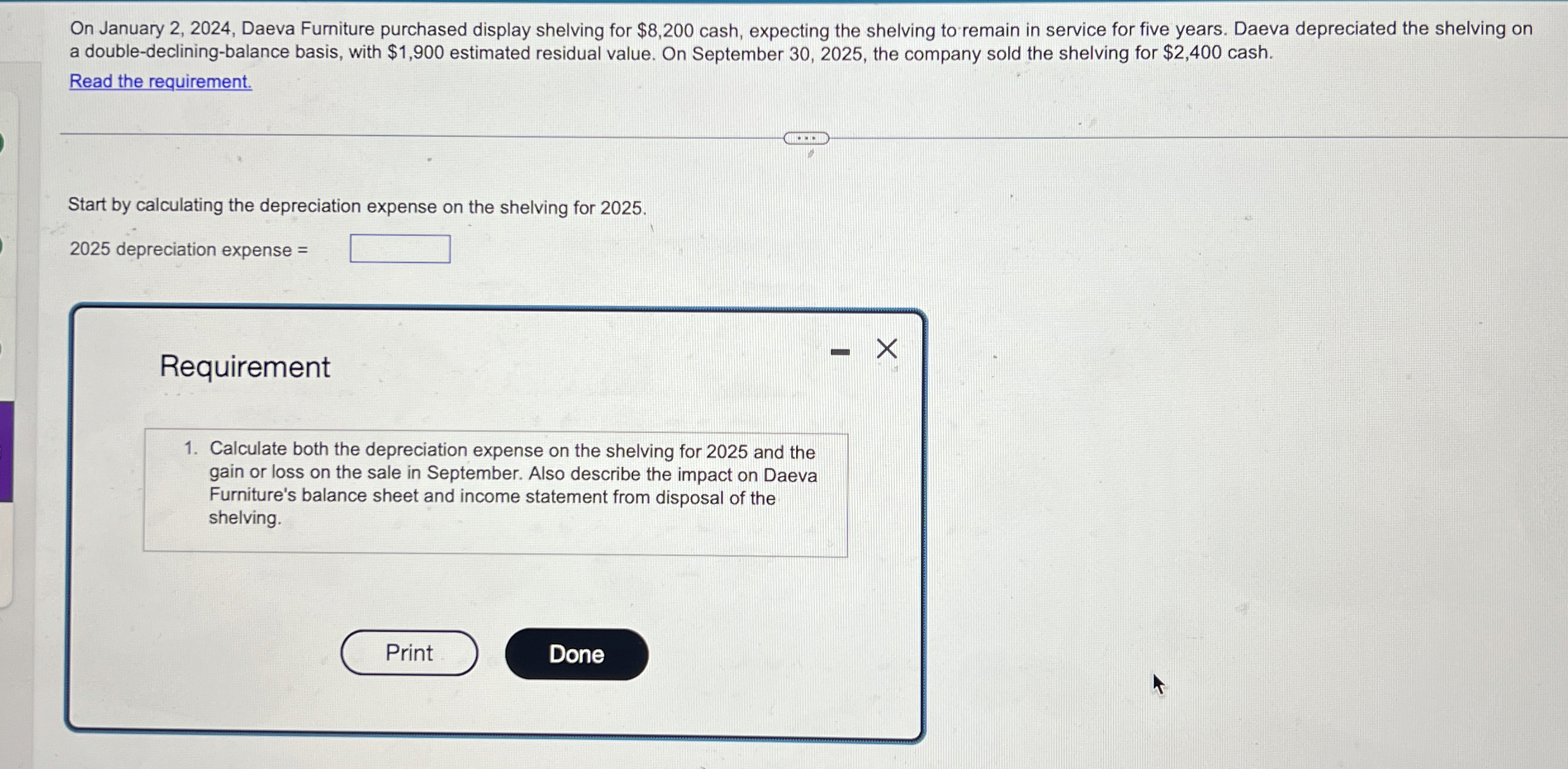

On January Daeva Furniture purchased display shelving for $ cash, expecting the shelving to remain in service for five years. Daeva depreciated the shelving on a doubledecliningbalance basis, with $ estimated residual value. On September the company sold the shelving for $ cash.

Read the requirement.

Start by calculating the depreciation expense on the shelving for

depreciation expense

Requirement

Calculate both the depreciation expense on the shelving for and the gain or loss on the sale in September. Also describe the impact on Daeva Furniture's balance sheet and income statement from disposal of the shelving.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock