Question: On January 2 , 2 0 2 4 , Intermediate, Inc. signed a four - year lease contract with Baker Corporation to lease manufacturing equipment

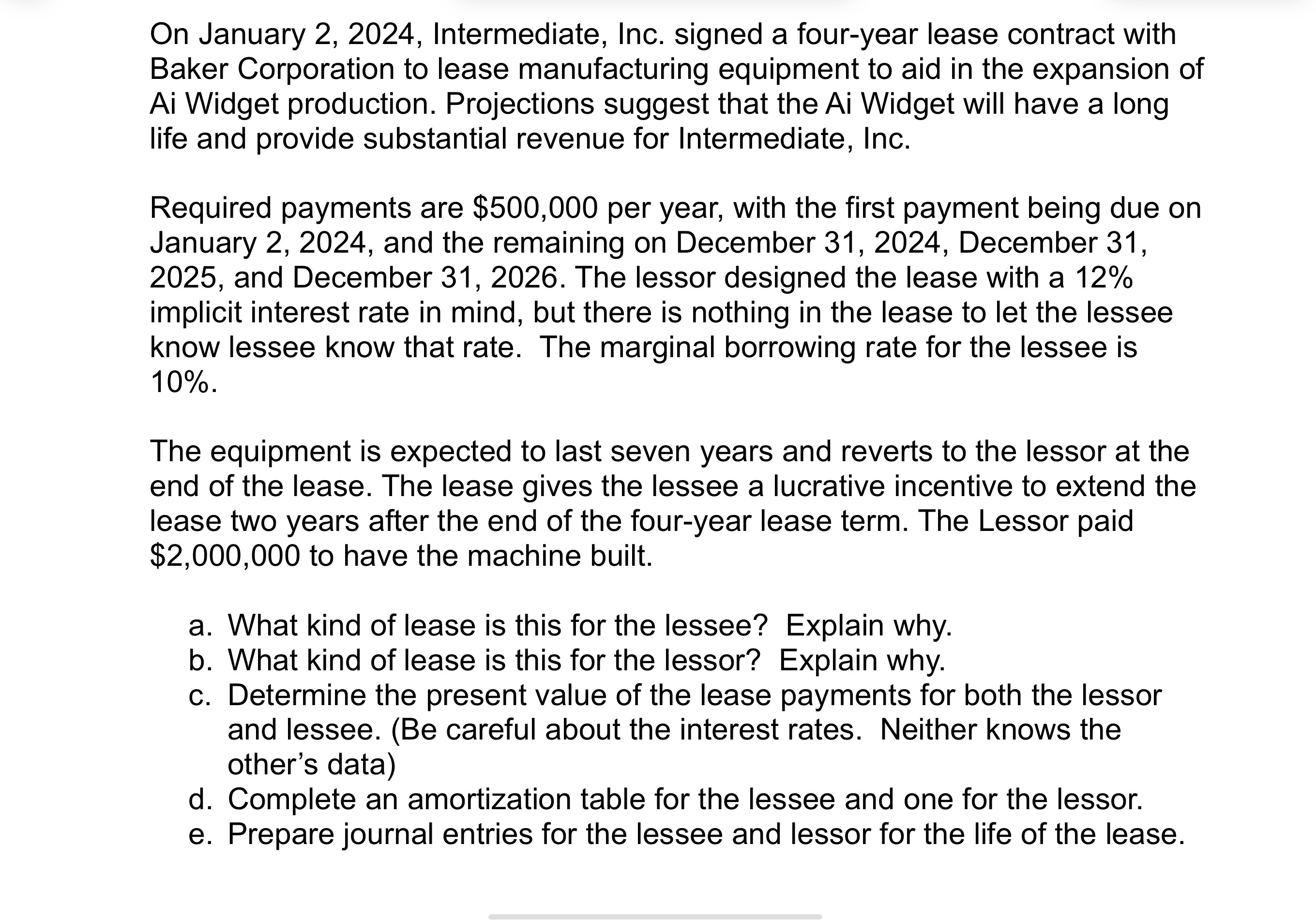

On January Intermediate, Inc. signed a fouryear lease contract with Baker Corporation to lease manufacturing equipment to aid in the expansion of Ai Widget production. Projections suggest that the Ai Widget will have a long life and provide substantial revenue for Intermediate, Inc.

Required payments are $ per year, with the first payment being due on January and the remaining on December December and December The lessor designed the lease with a implicit interest rate in mind, but there is nothing in the lease to let the lessee know lessee know that rate. The marginal borrowing rate for the lessee is

The equipment is expected to last seven years and reverts to the lessor at the end of the lease. The lease gives the lessee a lucrative incentive to extend the lease two years after the end of the fouryear lease term. The Lessor paid $ to have the machine built.

a What kind of lease is this for the lessee? Explain why.

b What kind of lease is this for the lessor? Explain why.

c Determine the present value of the lease payments for both the lessor and lessee. Be careful about the interest rates. Neither knows the other's data

d Complete an amortization table for the lessee and one for the lessor.

e Prepare journal entries for the lessee and lessor for the life of the lease.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock