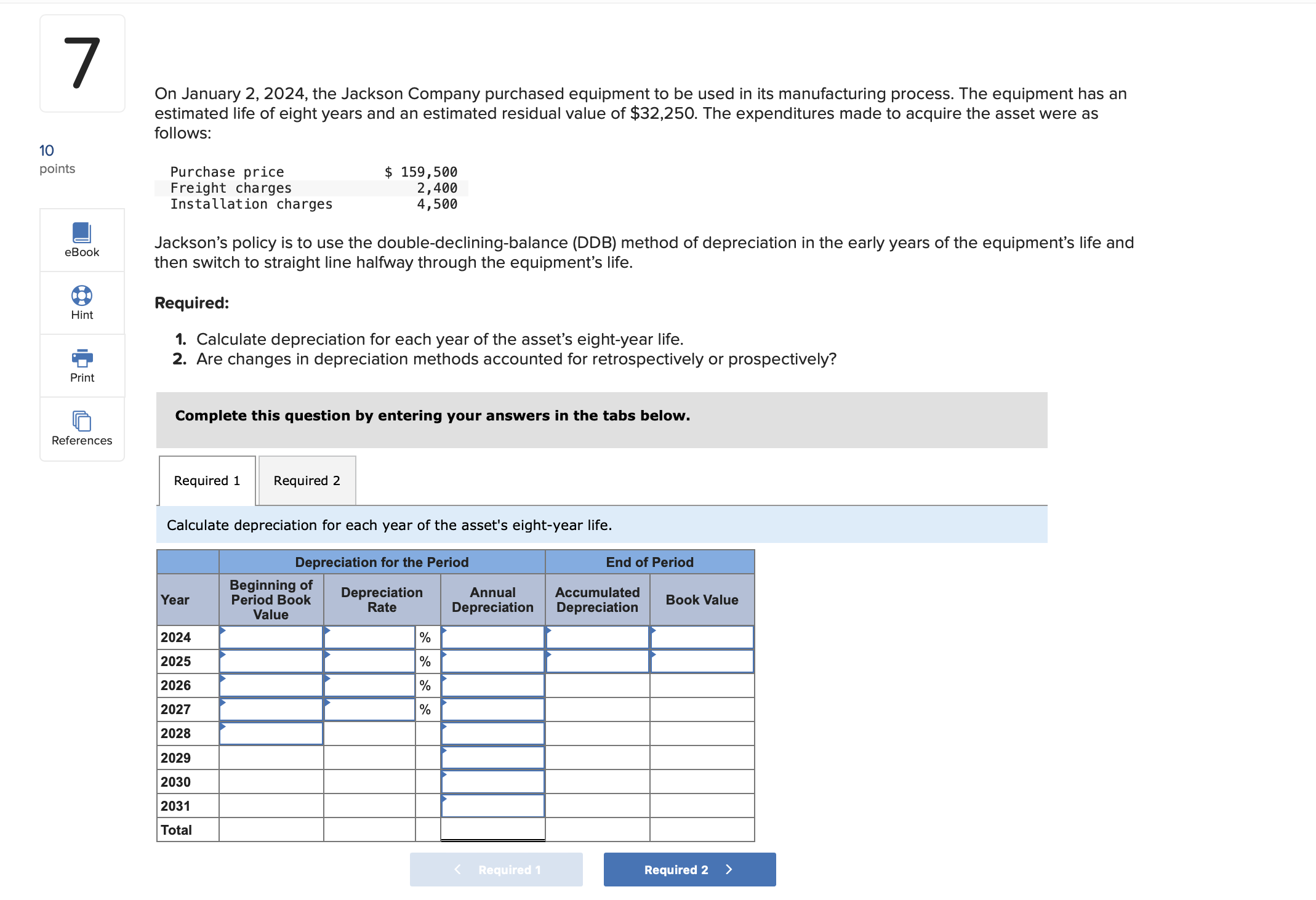

Question: On January 2 , 2 0 2 4 , the Jackson Company purchased equipment to be used in its manufacturing process. The equipment has an

On January the Jackson Company purchased equipment to be used in its manufacturing process. The equipment has an estimated life of eight years and an estimated residual value of $On January the Jackson Company purchased equipment to be used in its manufacturing process. The equipment has an

estimated life of eight years and an estimated residual value of $ The expenditures made to acquire the asset were as

follows:

Jackson's policy is to use the doubledecliningbalance DDB method of depreciation in the early years of the equipment's life and

then switch to straight line halfway through the equipment's life.

Required:

Calculate depreciation for each year of the asset's eightyear life.

Are changes in depreciation methods accounted for retrospectively or prospectively?

Complete this question by entering your answers in the tabs below.

Required

Calculate depreciation for each year of the asset's eightyear life The expenditures made to acquire the asset were as follows:

Purchase price $

Freight charges

Installation charges

Jacksons policy is to use the doubledecliningbalance DDB method of depreciation in the early years of the equipments life and then switch to straight line halfway through the equipments life.

Required:

Calculate depreciation for each year of the assets eightyear life.

Are changes in depreciation methods accounted for retrospectively or prospectively?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock