Question: On January 2, year 3, to better reflect the variable use of its only machine, Holly, Inc. elects to change its method of depreciation from

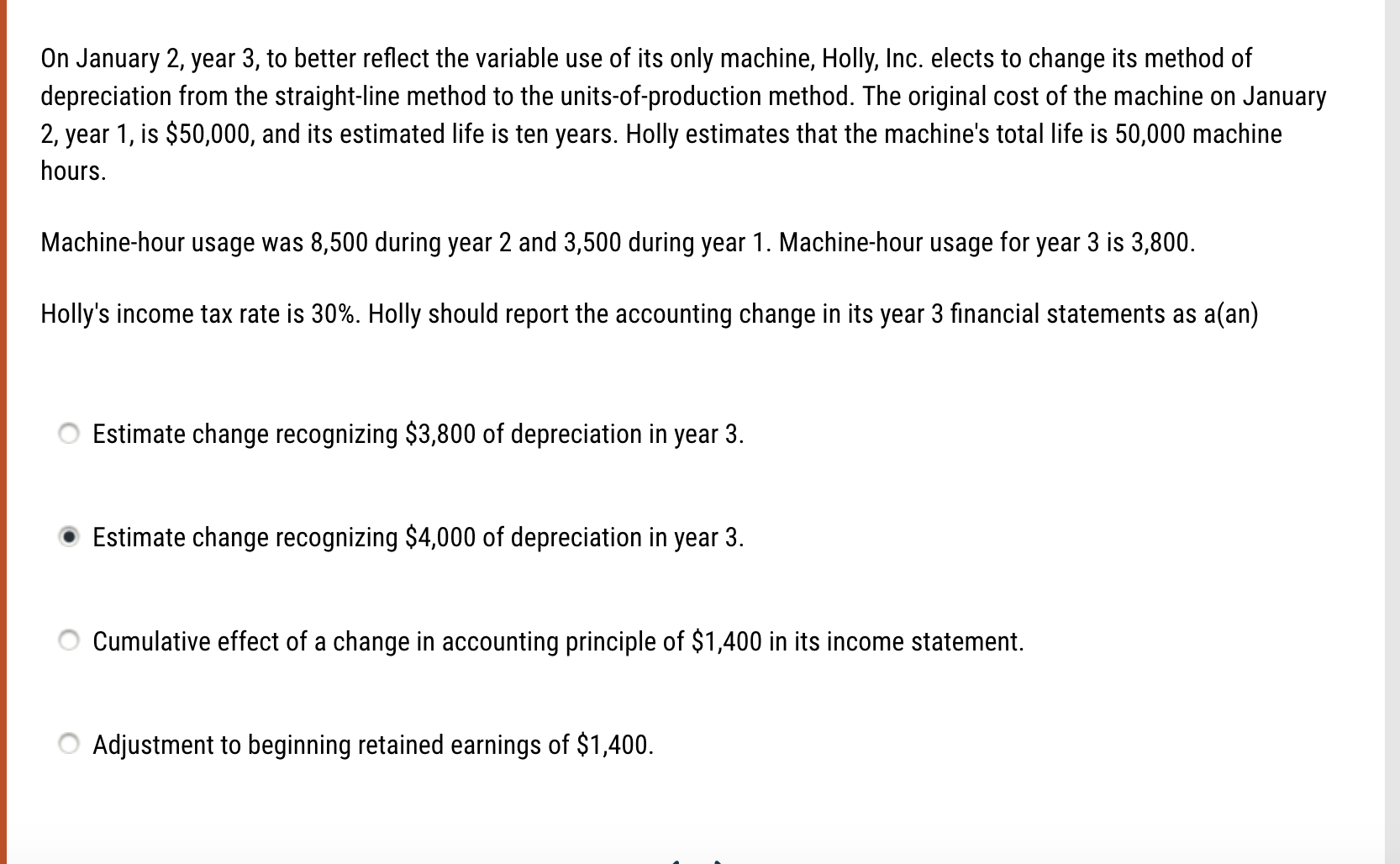

On January 2, year 3, to better reflect the variable use of its only machine, Holly, Inc. elects to change its method of depreciation from the straight-line method to the units-of-production method. The original cost of the machine on January 2, year 1 , is $50,000, and its estimated life is ten years. Holly estimates that the machine's total life is 50,000 machine hours. Machine-hour usage was 8,500 during year 2 and 3,500 during year 1 . Machine-hour usage for year 3 is 3,800 . Holly's income tax rate is 30%. Holly should report the accounting change in its year 3 financial statements as a(an) Estimate change recognizing $3,800 of depreciation in year 3 . Estimate change recognizing $4,000 of depreciation in year 3 . Cumulative effect of a change in accounting principle of $1,400 in its income statement. Adjustment to beginning retained earnings of $1,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts