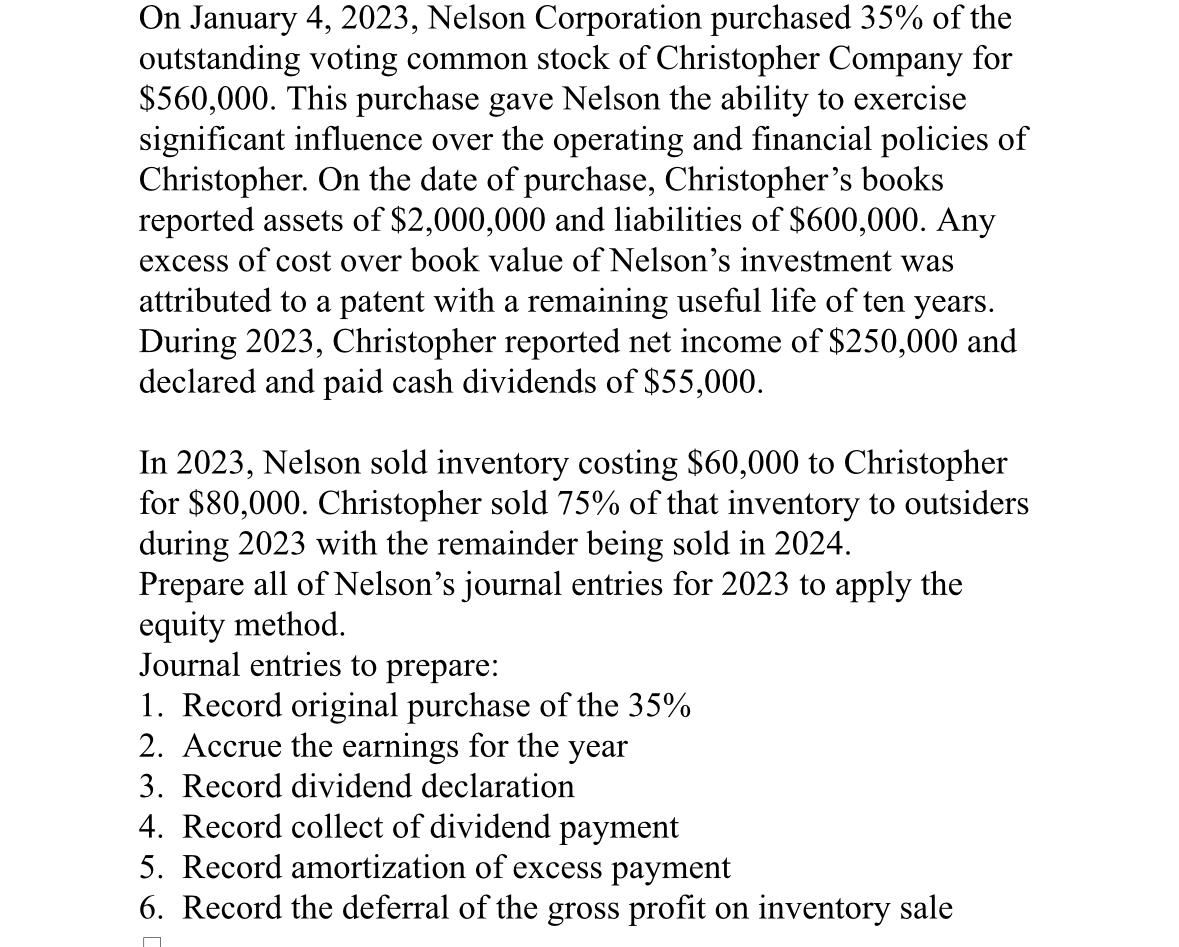

Question: On January 4 , 2 0 2 3 , Nelson Corporation purchased 3 5 % of the outstanding voting common stock of Christopher Company for

On January Nelson Corporation purchased of the

outstanding voting common stock of Christopher Company for

$ This purchase gave Nelson the ability to exercise

significant influence over the operating and financial policies of

Christopher. On the date of purchase, Christopher's books

reported assets of $ and liabilities of $ Any

excess of cost over book value of Nelson's investment was

attributed to a patent with a remaining useful life of ten years.

During Christopher reported net income of $ and

declared and paid cash dividends of $

In Nelson sold inventory costing $ to Christopher

for $ Christopher sold of that inventory to outsiders

during with the remainder being sold in

Prepare all of Nelson's journal entries for to apply the

equity method.

Journal entries to prepare:

Record original purchase of the

Accrue the earnings for the year

Record dividend declaration

Record collect of dividend payment

Record amortization of excess payment

Record the deferral of the gross profit on inventory sale

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock