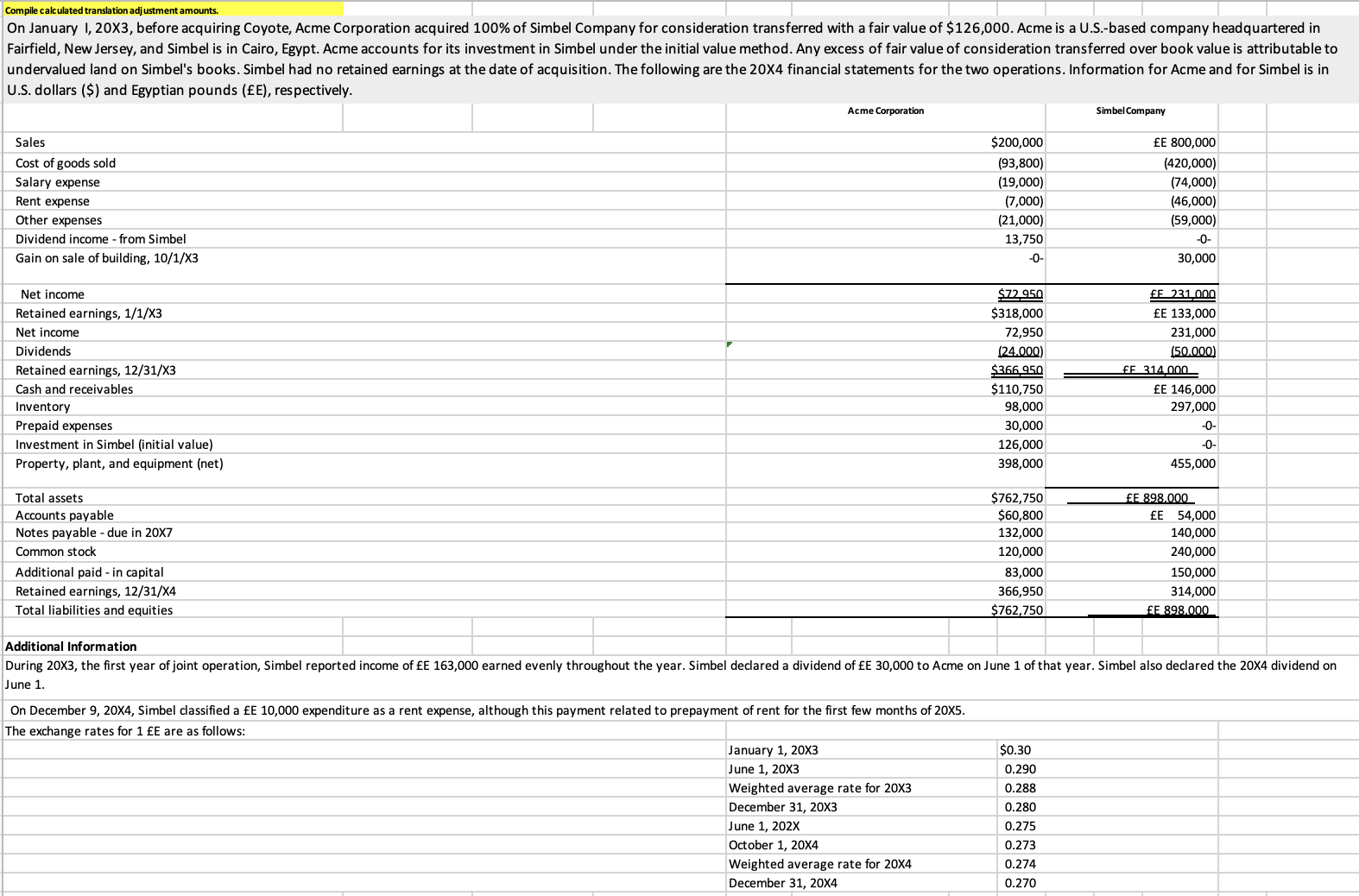

Question: On January I, 2 0 X 3 , before acquiring Coyote, Acme Corporation acquired 1 0 0 % of Simbel Company for consideration transferred with

On January I, X before acquiring Coyote, Acme Corporation acquired of Simbel Company for consideration transferred with a fair value of $ Acme is a USbased company headquartered in

Fairfield, New Jersey, and Simbel is in Cairo, Egypt. Acme accounts for its investment in Simbel under the initial value method. Any excess of fair value of consideration transferred over book value is attributable to

undervalued land on Simbel's books. Simbel had no retained earnings at the date of acquisition. The following are the X financial statements for the two operations. Information for Acme and for Simbel is in

US dollars $ and Egyptian pounds E respectively.

PLEASE ANSWER ALL PARTS; STEP ONE AND STEP TWO ACCORDING TO IMAGES FORMATS.

PART ONE

Must include Egyptian Pounds, the exchange rate and the Translation to US Dollars for each individual account

PART TWO

must include Acme Dollars, Simbel Dollars, Consolidation Entries, and Consolidated Balances for each individual account.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock