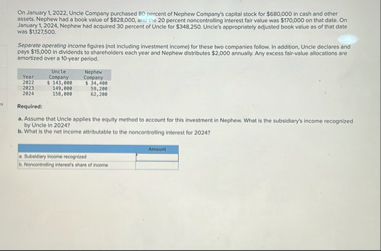

Question: On Jaruary 1 , 2 0 2 2 , Uncle Company purchased so mencent of Nephew Company's captal atock for $ 8 8 0 ,

On Jaruary Uncle Company purchased so mencent of Nephew Company's captal atock for $ in cash and other assels. Nephew had a book walue of $ anc ne percent noncentrolling interest fair value was $ on that date. On was

Separate operating income figures not including investinent income for these two comparies follow. In addition, Uncle declaves and pays $ in dividends to shareholibers each year and Nephew divtributes $ annually Any excess fairvalue allocations are anoritived over a year pelied.

tableYearLingle Conging,Maphey corresingJevened,e

Bluquired:

Assume that Uncle spples the equity memod to account for this investment in Nephers. What is Re subsidays income recognaed by Uncle in

b What is the retlinceme altibutable to the noncontrolling interest for

tableAmval Sheiliay Treters Texyelied,B Novergenteg reterifs shave of inoome,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock