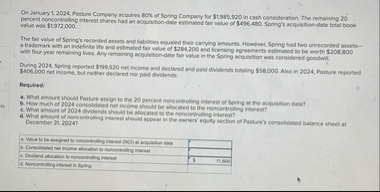

Question: On Jerfury 1 , 2 0 2 4 , Pesture Company acouines B 0 % of Spring Company for $ 1 9 8 5 ,

On Jerfury Pesture Company acouines B of Spring Company for $ in cash consideration. The remaining percent noncontrolling interest shares had an acquistiondate estimated fair walve Spring's acquistiondate total book value was $ a trademark with an indefinite life and estimated fair value of $ and lickinaing agreements estimated to be worth $ with fouryear nemaining lives. Alry remaining aceuistiondate fair value in the Spring acquition ess considered goodwill. $ net incerse, but nether declared nor paid dividends.

Required

b How ruch of conselsiated net income should be allocaled to the roncerterling interest?

What angunt of eviderds should be alscaled so the nercontrolling irterest?

December P

table Conweblest resincome allocation sis maniontrulling intereal, Ovelent allociation le noneontoding interse, Noncorboling interver in Spring,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock